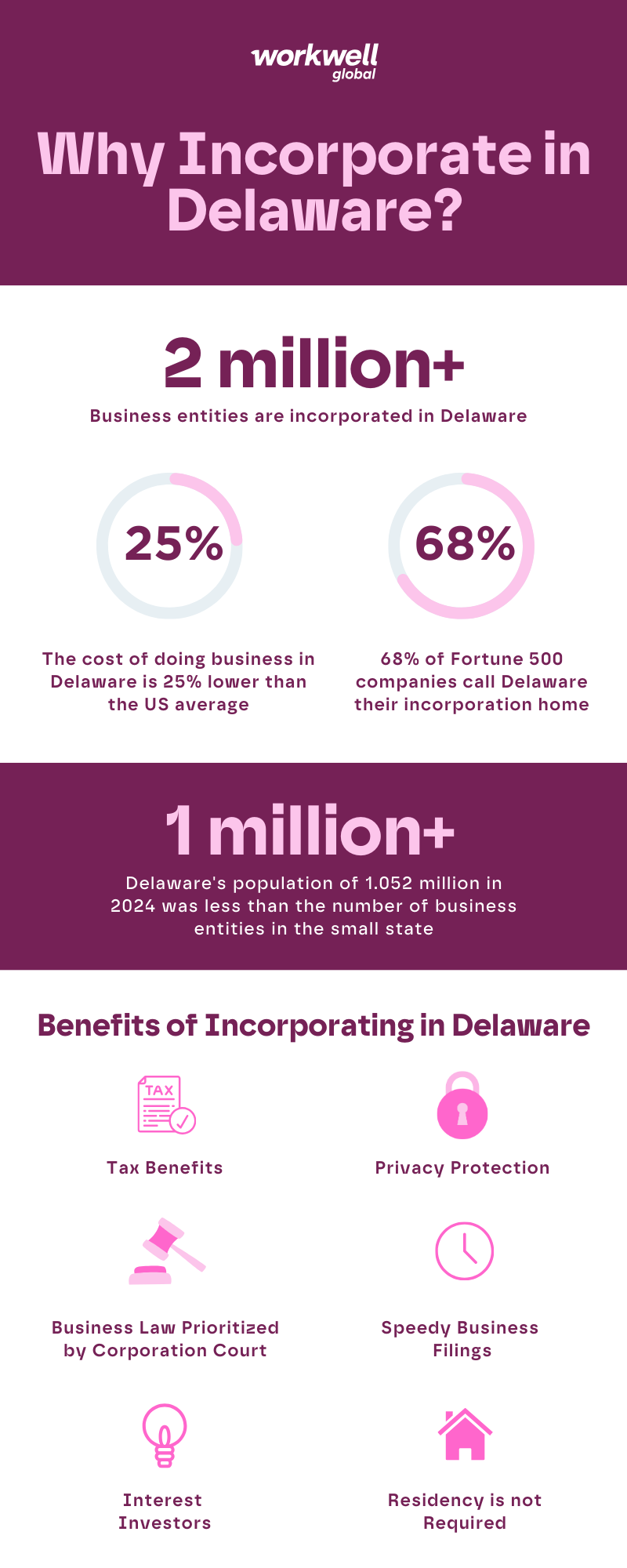

More than 50% of publicly traded U.S. companies have chosen to incorporate in Delaware, the home of over 2 million growing number of business entities that incorporate in Delaware is more than the small state’s population of 1.052 million in 2024. Please note that this article is for informational purposes only. It should not be used as a substitute for legal, tax, or accountancy advice.

The Benefits of Incorporating in Delaware

Deciding whether to incorporate your business in Delaware means weighing the pros and the cons. Aligning your business goals and objectives and examining how incorporating in Delaware will have an impact is something that needs to be considered.

1. Tax Benefits in Delaware

Delaware is famed for its cost of doing business, boasting a 25% lower overall cost of doing business than the US average, per the Delaware Prosperity Partnership. One of the main reasons why so many companies are incorporated in Delaware is because, generally, and absent other tax considerations, a physical business address is not required for incorporation and individuals do not need to live in Delaware, so long as the business has and maintains a Registered Agent in the state. This Registered Agent may be either an individual resident, a domestic entity, or a foreign entity authorized to transact business in Delaware.

Additional tax benefits to incorporating in Delaware can include:

- No corporate income tax on income derived from outside of Delaware. Delaware’s corporate income tax rate is 8.7%, but this generally applies solely to income earned from business activities within the state.

- No state or local sales tax.

- No tax on investment or intangible income for companies with in-state activities limited to managing intangible assets.

- No personal property taxes.

- No inheritance tax, and no estate tax for individuals who died after January 1, 2018.

2. Expedited Business Filings

Delaware is known for its fast and efficient incorporation process, making it perfect for business owners who are looking to establish their company quickly. However, this benefit comes with additional fees, which can be as costly as $1,000. The state offers business filings that can be processed on the same day or within as little as one hour.

Delaware’s expedited business filing options include:

- 24-hour processing

- Same day processing

- Two-hour expedited service

- One-hour expedited service

3. Privacy and Structural Benefits

There are privacy benefits to incorporating in Delaware. Specifically, Delaware does not require public disclosure of the names of shareholders, directors, and officers. This information is maintained by the corporation itself. Only the name and address of the Registered Agent are required to be filed with the state.

Furthermore, Delaware allows for a single individual to serve as the sole director, officer, and shareholder of the corporation, which may be appealing for small businesses and startups.

4. Business Law Prioritised by a Dedicated Corporation Court

Delaware’s reputation for being corporation-friendly stems from the favourable business laws the state offers. The Delaware Court of Chancery is widely recognized as the nation’s “preeminent forum” for disputes involving corporations.

When businesses are selecting a state to incorporate in, their choice determines which jurisdiction governs their internal affairs. By choosing Delaware, they are guaranteed advanced and predictable business laws. The specialized court and use of judges over juries allows the state to prioritize and resolve corporate lawsuits quicker than the lengthy trial systems present in other states.

Furthermore, Delaware’s laws are constantly evolving based on market changes and judicial interpretations. As recently as last month, Delaware Governor Matt Meyer signed into law numerous amendments to the Delaware General Corporation Law to provide greater predictability and reduce ambiguity for businesses, following several recent high-profile and controversial decisions by the Court of Chancery.

Join the Fortune 500 Companies Incorporated in Delaware

According to the Delaware Division of Corporations, 67.6% of Fortune 500 companies are incorporated in Delaware. The state has established itself as the go-to destination for incorporation for many big companies, proving it is a tried and successful method.

Facebook, Google, Morgan Stanley, Ford, Apple, and Walt Disney are a few of the many global giants incorporated in Delaware. Interestingly, most of these companies have a Registered Agent Office in Wilmington. The building is home to 285,000 American and foreign businesses, housing more companies than anywhere else in the world.

Disadvantages of Incorporating in Delaware

1. A Price to Pay for Tax Benefits

The tax benefits in Delaware come at a relatively small price. To maintain good standing in Delaware, Delaware corporations are required to file an Annual Franchise Tax Report and pay an annual franchise tax. This tax is based on either the number of authorized shares within the corporation or the assumed par value capital method, whichever results in a lower tax burden. As such, as a corporation’s share value goes up, its franchise tax liability increases. However, the franchise tax is typically minimal in comparison to the corporate income tax levied in other states.

2. Filing Fees in Delaware

Despite boasting the fastest turnaround time to file a business in the US, the filing process comes with a catch. Delaware’s filing fees can end up being significantly higher than other states. As of August 2024, the initial filing fee for a domestic corporation in Delaware is $109, and $245 for a foreign corporation. The Delaware Division of Corporations provides a complete corporate fee schedule.

Additional filing fees can include:

- Name reservation

- Registered Agent designation

- Filing an annual report

- Annual franchise tax

- Certified copy of the incorporation or formation documents

When you compare this to the likes of Florida, which charges a $35 filing fee for both domestic and foreign corporations, the overall filing costs in Delaware can become expensive.

3. Businesses Must Follow State Requirements Outside of Delaware

Many businesses incorporate in Delaware but primarily conduct business in another state. In such cases, the corporation must still comply with that state’s applicable filing and licensing requirements for foreign entities. This can result in duplicate filing obligations and costs, which is one of the more significant disadvantages of incorporating in Delaware.

Furthermore, some states impose an out-of-state business or franchise tax – meaning the corporation would be required require pay this tax in addition to Delaware’s franchise tax, which can offset any tax savings achieved. For example, under California law, a Delaware corporation “doing business” in California must register in California and pay an $800 minimum annual franchise tax, even if incorporated in Delaware.

4. Businesses Need a Registered Agent in Delaware

When incorporating in Delaware, a Registered Agent is required to accept legal filings on your behalf. This is especially necessary for businesses operating outside of the state. Registered Agent services expenses can range from $50 to over $300 per year.

5. Practical Considerations of Legal Disputes in Delaware

While not all legal disputes must necessarily be handled in Delaware, internal governance matters are generally subject to Delaware jurisdiction. When cases do proceed in the Court of Chancery or similar Delaware courts, they require representation by a Delaware-licensed attorney. Moreover, in-person proceedings may be necessary, which can become a headache, especially for smaller businesses in the event that travel is required. With company lawsuits being all too common in the US, these potential and unexpected legal expenses can create a disadvantage to incorporating in Delaware.

Amendments intended to address concerns of the “Delaware Exit”

With the laws in Delaware regularly updating, the changes made by the Delaware governor aren’t welcomed by all, with critics referring to them as the “billionaires bill”. The amendments are intended to address concerns raised by Delaware corporations, resulting from a number of recent controversial Delaware Court of Chancery decisions, leading some companies (particularly those with controlling stockholders) to reincorporate or consider reincorporating to other states (particularly Nevada and Texas), a phenomenon being referred to as the “Delaware Exit” or “DExit”.

As a results of this, Delaware is facing incorporation competition from Texas and Nevada. For example, Elon Musk moved Tesla’s incorporation to Nevada, with Meta and Walmart, among other high-powered corporations, “reportedly considering leaving” too.

Ready to Incorporate in Delaware? Align Your Business Objectives First.

Delaware offers a host of business-friendly benefits that companies can leverage by incorporating in the state. It is important to note that Delaware’s popularity with Fortune 500 companies comes down to such companies’ ability to afford the additional costs of incorporating in the state.

The regular travel for legal disputes and additional filing costs are relatively insignificant for these large companies, but may often outweigh the tax-saving benefits for small businesses. Knowing the best state in which to incorporate your business is a good starting point to figure out the best-matched state requirements for your business.

Here at Workwell Global, we’ve been helping international companies hire talent, whoever and wherever, in North America for over 25 years by removing certain barriers of engaging workers with our Employer of Record services.

Over this time, we have built up partnerships with experts who support companies expanding globally and will happily guide you to the right expert for advice on incorporation.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.