The United States is made up of 50 states, each with its laws governing how businesses operate. These differences may include everything from corporate income taxes to litigation procedures, and they can significantly impact how your business operates. Choosing the right state in which to incorporate your business is one of the most important decisions when entering the US market.

In this blog, we’ll discuss the key factors to consider when choosing a state for incorporation and offer suggestions on which states may match your business objectives.

Please note, the information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.

What To Consider When Choosing a State to Incorporate In?

One advantage of doing business in the US is the flexibility to incorporate in any state, not just the state in which your business operates. But if you are physically operating in another state, that entity must register as a foreign entity in that second state. However, such flexibility may be overwhelming when deciding the best state for incorporation.

You may be inclined to incorporate in a different state due to better business incentives. However, it’s important to consider that fee structures and tax implications can vary, both by state and entity type (such as limited-liability corporations, corporations, partnerships, etc.). Additionally, incorporating in a state other than where your business operates may result in additional tax liabilities, especially if your business establishes a nexus in the state of operation.

Formation Fees

Formation fees are charged when you initially register your business in the state of incorporation. Formation fees will vary by state and entity type; as such, it may be useful to compare the fees of the states in which your business is interested.

Annual Fees

States often require businesses to file annual or biennial reports to remain in good standing. These annual fees will vary by state and business structure.

Filing Fees

Additional filing fees may apply when making changes to your business. Such changes can include amending the business’s name, updating the registered agent, or converting your entity type (e.g., from a corporation to an LLC). Again, these amounts may differ based on the type of entity being modified.

Tax Considerations

State tax requirements will also vary, including by entity type. Such state-level taxes can include corporation income tax, franchise tax, sales and use taxes, and gross receipts tax. Moreover, it is important to consider any additional tax liabilities if your business has an established nexus in other states.

States with low incorporation taxes

Many states implement lower corporate tax rates as a way to attract businesses to incorporate within their jurisdiction.

States like Wyoming and South Dakota are popular for incorporation purposes as they do not impose a corporate income tax. Other states, such as Nevada, Ohio, Texas, and Washington, also do not impose a corporate income tax; however, these states apply gross receipts tax or similar entity-level taxes. A gross receipts tax is a tax on the total gross revenues of a business, regardless of profitability or expenses. Some states, such as Delaware, Oregon, and Tennessee, impose gross receipts taxes in addition to corporate income taxes.

According to the Tax Foundation, North Carolina decreased its corporate income tax from 2.5% to 2.25% as of January 1, 2025. Nebraska and Pennsylvania have also lowered their corporate income tax rates in recent years.

Understanding the nuances of tax laws between states is essential in determining the state of your business’s incorporation, as a state’s tax structure can make a significant difference to your business’s overall costs and tax rates.

States with high corporate income taxes

In contrast, the states with high levels of Corporate Income Tax, which may be a consideration for cost-sensitive businesses, include:

- New Jersey (9%), with an additional surtax of 2.5% for certain corporations

- Minnesota (9.8%)

- Illinois (9.5%)

- Alaska (9.4%)

- Pennsylvania (7.99%)

- California (8.84%)

As these tax percentages gradually increase every year, it is important to be aware and assess the different tax laws when researching states to incorporate, which can make a difference to your business’s overall costs.

Corporate Laws

Each state has its own corporate laws, which govern the internal affairs of your company and dispute resolution. Therefore, it is important to understand how each state’s corporate laws may impact your company’s governance, shareholder rights and protections, and ability to resolve internal disputes.

One of the most popular states for businesses is Delaware, as it is widely considered the most business-friendly state for incorporation.

According to Delaware’s Secretary of State, 66% of the Fortune 500 companies have chosen Delaware as their legal home, for reasons such as:

- Low tax rates

- Favourable privacy and security laws

- Shareholder flexibility and protections

- Well-developed corporate law

Many investors prefer Delaware corporations due to the predictable interpretation of laws and favourable tax laws. For more information about whether Delaware is the right state to incorporate your business, check out our breakdown of the pros and cons of incorporating in Delaware.

Privacy Laws

Some states provide greater privacy for businesses by limiting the public disclosure of shareholder or officer information in formation documents. Certain states in the United States have advantageous privacy laws that offer greater protection and confidentiality for corporations.

It’s important to note, however, that such privacy laws exist at a state level only. New federal requirements under the Corporate Transparency Act require foreign entities that meet the definition of a “reporting company” to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN). Per the Act, foreign reporting companies are entities (including corporations and limited liability companies) formed under the law of a foreign country but registered to do business in a U.S. state.

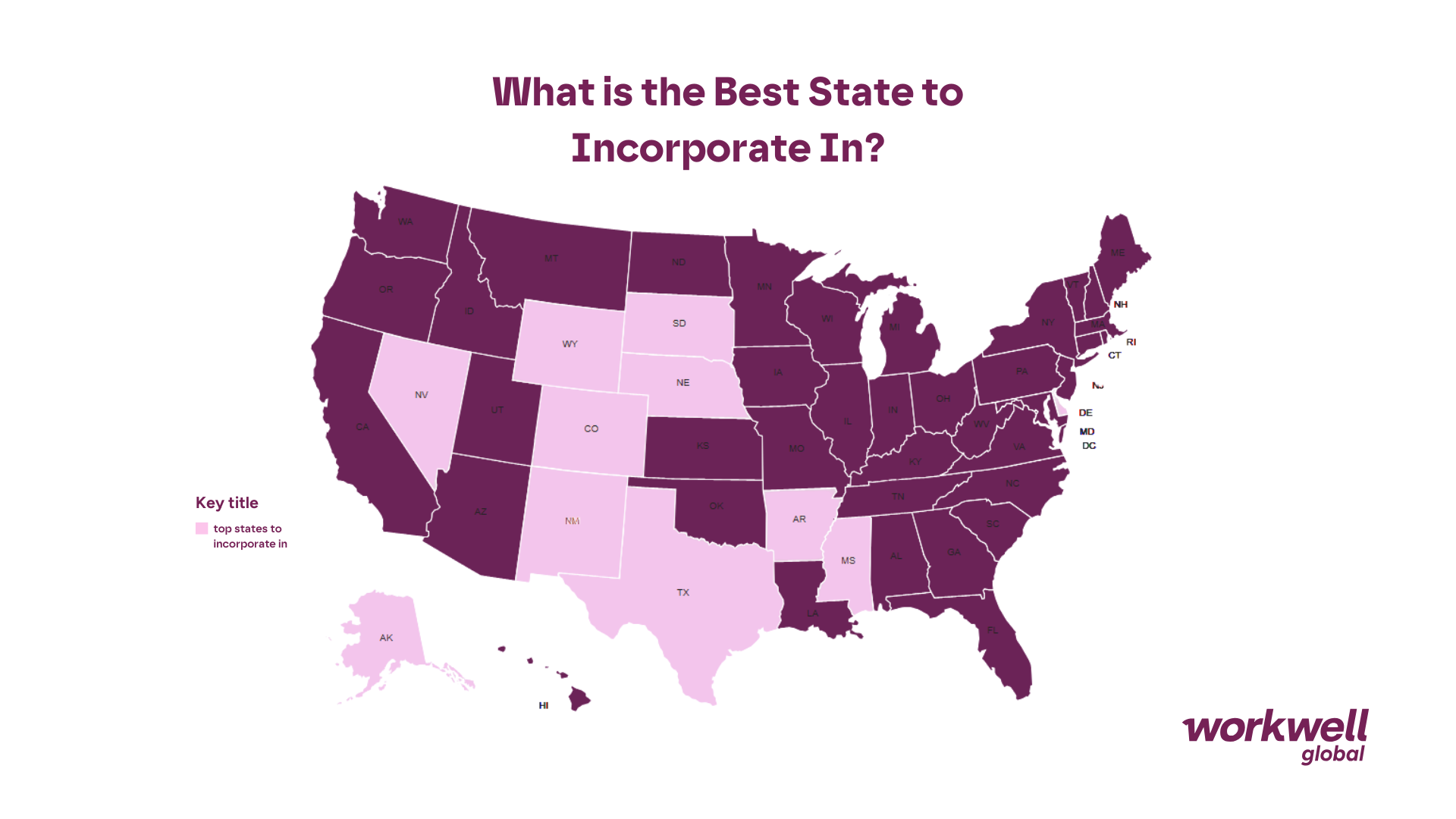

What are the Popular States to Incorporate Your Business In?

States that are often considered favourable for incorporation due to their tax structures, corporate fees, and legal systems include:

Delaware

Known for its well-developed court system, Delaware is one of the most popular states for incorporation. Delaware’s Court of Chancery is a specialized business court known for its expertise in corporate matters, ensuring a fair and efficient dispute resolution process. Furthermore, Delaware does not require disclosure of shareholders or directors in public formation documents, though disclosure may still be required under the federal Corporate Transparency Act.

Wyoming

Wyoming is a cost-effective option for incorporation. Wyoming does not levy a corporate income tax, franchise tax, and gross receipts tax, though businesses may be required to comply with other tax obligations. There are also strong privacy protections at a state level, as Wyoming does not require disclosure of information; though, such disclosure may be required under the federal Corporate Transparency Act.

New Mexico

New Mexico has become a popular state for businesses to incorporate in recent years. While there is no inventory tax, state-level property tax, and annual franchise tax for LLCs, corporations must still pay a corporate income tax.

Alaska

Alaska has no state-level sales tax, though some local jurisdictions may impose sales taxes, and certain businesses may benefit from no state income tax, depending on the business’s entity structure; for these reasons, Alaska has become a popular state for incorporation.

The Best State to Incorporate in Depends on Your Business Objectives

Choosing the best state to incorporate in is an important step, but by no means the only one. Overall, the decision largely depends on your business objectives. While one attribute, such as low filing fees, can offer significant advantages, it is important to evaluate all aspects, including tax obligations and regulatory requirements. We advise reviewing the state’s Secretary of State websites to help determine which state is the right fit for your business.

If you are looking to employ staff in the United States, Workwell Global can help simplify this process by using our specialised Employer of Record USA service. Book a call with our employment experts today, who can guide you through how you can start doing business in the US and how you can remain compliant as you hire employees to build out your business.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.