According to Staffing Industry Analysts, the France staffing market is estimated to be worth $37.7 billion in 2025, with projections reaching $38.17 billion by 2026. For those new to the market, in this blog, we will be breaking down the France recruitment industry insights for 2025 and discussing:

- Trends Impacting Recruitment in France

- Growing Sectors in France for Recruitment Agencies to Target

- How to stay compliant when placing contractors in the France Recruitment Industry

Size of the France Recruitment Market

The French staffing market is one of the most well-developed markets in the world and is the second biggest market in the EU. In 2024, the European staffing market was valued at €579 billion according to SIA.

France generated nearly $34.87 billion dollars of this overall revenue in 2024. Within France, there are estimated to be around 1,254 staffing agencies according to SIA. The largest recruitment agency in France is Adecco, with revenues of approximately €4.9 billion in 2023, followed by Manpower at €4.1 billion. Despite a 5% contraction projected for the French staffing industry in 2024, with no growth anticipated in 2025 there is a 4% growth projected for 2026.

Trends Impacting France Recruitment

Investment in Tech Within France

Companies in France have been steadily adopting digital platforms and solutions. Since the 2017 election, France’s President Emmanuel Macron (who is still president today) has prioritized the expansion of the French digital services market. As a result of this, the most in-demand tech jobs in France in 2025 include AI specialists, cybersecurity experts, and data engineers, increasing the opportunity for recruitment agencies that specialise in tech recruitment in France.

The increasing use of technology is transforming industries across Europe, with a strong emphasis on preserving “digital sovereignty” and reducing reliance on US technology giants. This is evident in France, where traditional service areas have steadily embraced digital platforms and solutions, according to Statista’s insights .

In 2023, e-commerce sales in France reached approximately €160 billion, making a significant growth of nearly 10.5% from the previous year’s total of €144.7 billion, signaling the retail industry’s shift to digital platforms. Subsequently, the trending data shows that workers in France will require reskilling and strategic guidance toward roles in the digital services sector. Representing an opportunity for new and existing recruitment agencies focusing on the IT/tech sector in France.

With the increasing use of tech in the France recruitment industry, staffing firms that strategically use advanced technology in their operations are well-positioned to achieve a competitive advantage in the rapidly evolving digital landscape.

Economic uncertainty in France

Like much of Europe, France has faced economic uncertainty, narrowly avoiding recession in 2023. In September 2024 temporary employment fell to 742,700 full-time equivalents, which was down 53,000 (-6.7%) from the previous year, with a sharper decline than August.

Although GDP growth in France has averaged +0.3% quarterly since Q1 2023, it has slowed over the past three quarters. The IMF forecasts annual growth of +1.1% in 2024, holding steady in 2025, and slightly improving to +1.3% in 2026.

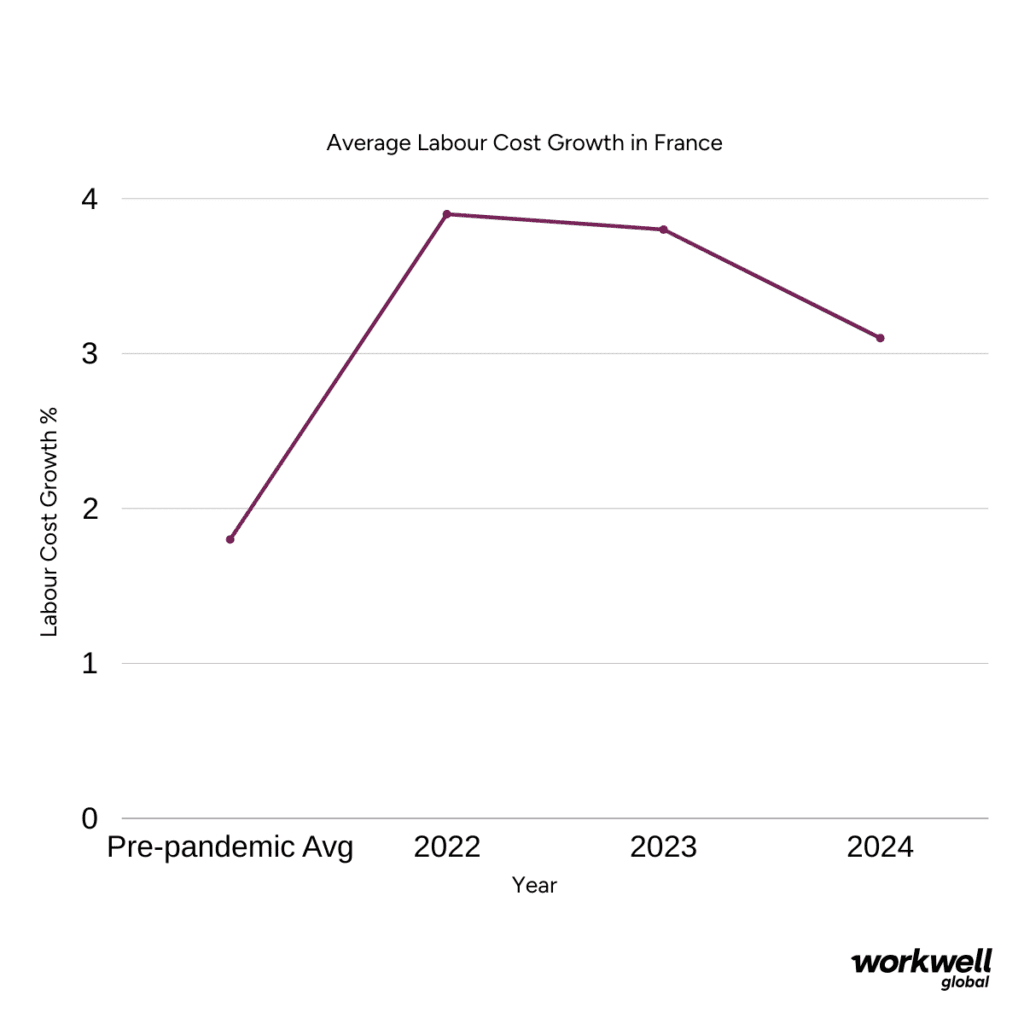

Cost of Labour in France

Labour cost growth in France averaged 1.8% on a Y/Y basis prior to the pandemic but it was already quite uncertain then. The post-pandemic era saw peak labour cost growth of 4.6% in Q4 2022, and average growth of 3.9% over the course of 2022 and 3.8% in 2023.

Over the first half of 2024, labour cost growth in France averaged 3.1%, leaving growth effectively unchanged from late 2023. This follows the path of inflation, which began falling again in Q3 2024, suggesting labour cost growth may decelerate again soon.

How will rising labour costs impact hiring in France?

France reportedly was the fifth country in the European Union with the highest hourly labour costs.

France’s labour costs have become a central issue in economic and social policies. The government’s pension reform, which requires people to work two years longer, has sparked protests, partly due to the harsh and intense working conditions many employees face.

French companies have long viewed high labor costs, driven by social contributions, as a key reason for unemployment and low competitiveness. A reduction in the growth of labour costs may lead to an increase in hiring activity from companies in France.

Growing sectors in France for Recruitment Agencies

Even though the French economy (like much of Europe) is going through a period of uncertainty, it’s not all doom and gloom! France’s ability to attract global investment is creating thousands of new job opportunities, further cementing it’s position as a major recruitment market.

According to Statista, the number of employed people in France was forecast to continuously increase between 2024 and 2025 by in total 100,000 people (+0.35% growth ). The number is estimated to amount to 28.6 million people in 2025.

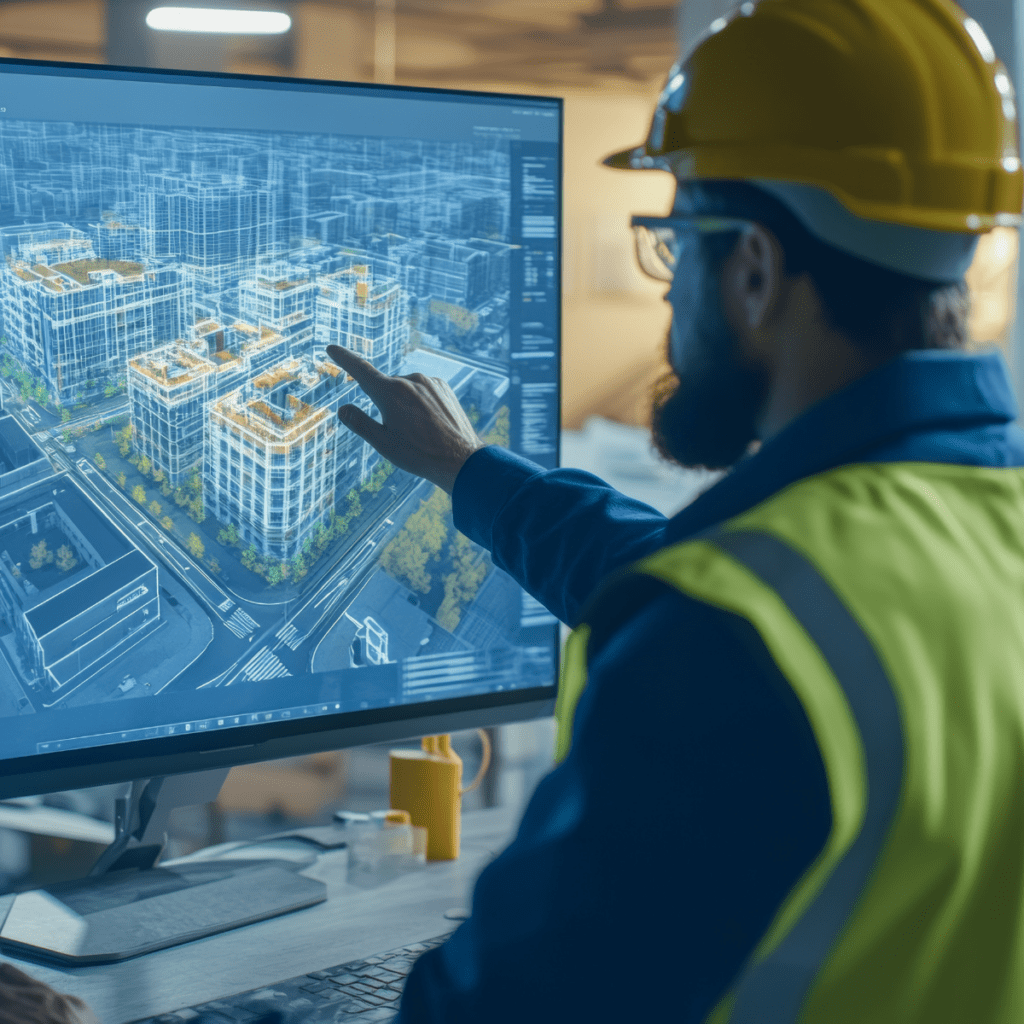

Construction

The market size of the building and construction industry in France is projected to be worth €95.4bn in 2025.

In recent years, the French construction industry has faced significant challenges. After the COVID-19 pandemic and dealing with material shortages in 2021 and 2022, construction prices rose due to spiking energy costs in 2022, which eventually eased in 2023.

Material and equipment costs also increased, at a slower rate. Additionally, labour shortages had been a major obstacle, but by mid-2024, insufficient demand became the primary issue affecting building activity.

Although the French construction industry is facing challenges, including a decline in 2024 due to economic conditions and slower project developments, construction offers growth opportunities in sustainability and infrastructure development.

Observing the historical market data of the building and construction industry in France, there has been a declining compound annual growth rate (CAGR) of 2.4 % between 2019 and 2024. However, the industry is expected to steadily grow over the next year and beyond, with a projected annual growth rate of 2.8% from 2024 to 2028. By 2028, the construction output is estimated to reach EUR 180.54 billion.

Even with the market decline between 2019 and 2024, there are 55,388 recorded businesses in the building and construction industry in France according to Ibisworld, which has grown at a compound annual growth rate of 2.1 % during the same period.

The construction industry in France is a key driver of the nation’s economy, covering sectors like infrastructure, residential, and commercial projects. With its substantial impact on GDP and employment, the market is both dynamic and highly competitive.

Key trends shaping France’s construction market:

- Digital Transformation

Digital tools are reshaping construction in France, innovations like tender management systems enhance efficiency and offer a competitive edge.

- Sustainability and Green Building

France is a leader in green construction, with strict environmental regulations and a focus on energy efficiency. Adopting eco-friendly solutions is essential to stay competitive.

- Infrastructure Modernisation

Large-scale projects, such as high-speed rail and renewable energy installations, are driving industry growth in France. Tools like project discovery platforms help businesses tap into these opportunities.

IT

France’s IT services market is the sixth largest in the world. It currently occupies around 4.4% of the global market and represents 32% of France’s overall IT sector.

In 2022, the French tech sector grew by 6%, making it the only major European tech economy to expand that year. The cloud-software industry, particularly in specialised fields like manufacturing, healthcare, property management, and transportation, is thriving, supported by new government regulations encouraging digitisation, as mentioned previously

French software companies like AI firm Mistral, which secured investment from Microsoft, and business-planning software company Pigment, which raised $145 million from a U.S. investor, are gaining global attention. The IT services market in France is projected to reach $65.55 billion in 2025, with IT outsourcing leading at $27.90 billion.

The market is expected to grow at a steady rate of 4.7% annually from 2025 to 2029, reaching $78.77 billion by 2029. This growth is driven by the country’s focus on digital transformation and the increasing demand for cybersecurity solutions.

In France there is an estimated increase of 21% in roles focusing on AI, machine learning, and cybersecurity. Job postings for generative AI skills have jumped 6.8x, making it one of the hottest sectors for career growth. This trending sector provides recruitment agencies with significant opportunities to expand globally, by sourcing and placing top-tier professionals in these high-demand fields. Agencies can use this growth to increase their global reach and establish themselves as leaders in the IT market.

Transport and Logistics

According to Global data, France saw 3,313 active job postings in January 2024. The logistics market in France recorded a revenue of $121.4 billion in 2024 and is projected to reach $190.6 billion by 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 7.8% from 2025 to 2030 according to Horizon grand research.

In 2021, France had the largest number of people employed in the transport sector with 842 thousand taking up 13.9% of the european union.

These figures show that France has a well-established transport sector with a large workforce. With the ongoing demand for specialized roles, temporary positions, and contractors to meet the needs in transport and logistics. The anticipated growth of the industry makes it a reliable and lucrative market.

Healthcare

According to the World Health Organization, France ranks 6th globally in terms of investment (public and private) in healthcare. The healthcare industry was France’s 3rd largest exporting sector in 2022, representing €28.3 billion.

Some in demand roles for healthcare in France include:

- Nursing Professionals

- Pharmaceutical Assistants

- Pharmaceutical Assistants

- Human Resource Managers

- Healthcare assistants

By 2025, the revenue in the Digital Health market is projected to reach $4.59 billion in 2025, with an expected annual growth rate of 7.1% across 2025-2029, resulting in a projected market volume of $6.04 billion by 2029.

The growth of the Digital Health market is a huge opportunity for agencies to target in the France recruitment industry. The hiring needs, due to projected market growth, and opening niches for firms specialising in digital and healthcare roles are huge.

How to Place Contractors in the France recruitment market

In this section, we dive into key compliance considerations for recruitment agencies in France and guidance with how to stay compliant in the France recruitment industry. Below we break down:

- Worker classification

- Misclassification

- Minimum wage in France

- Paid leave entitlement

France is different to most other recruitment markets, as it is highly litigated. Much of the regulation derives from anti-slavery legislation where the objective of financial gain from the services of another human being is prohibited.

Worker classification in France

In France, the two most common engagement models are independent contractors and employed.

Both independent contractors and employees work and get paid, but the key difference lies in their relationship with the company. In many cases, the main determination for classification is level of subordination.

French law defines subordination as working under an employer’s authority, meaning the employer can give orders, oversee the work, and penalise poor performance.

These engagement models are not without risk. French law permits consultancy (consulting or statement of work) where genuine oversight, supervision direction, control and liabilities remain with the consultancy. However, for a recruitment agency there is typically no place in the supply chain. Even moving to a “margin only” approach, which would significantly reduce the visibility of the agency, does not take away the risk completely. This risk can be mitigated by working with an Employer of Record with a local entity in France.

What happens if you misclassify a worker in France?

If French authorities determine that a working arrangement, such as a contractor or freelance relationship, is an employer-employee relationship, the company could face serious legal and financial repercussions. These consequences might include:

- Reassessment by the social security URSSAF (Organisations for the Collection of Social Security and Family Benefit Contributions):

- The company who misclassified an independent contractor in France will be liable for the social contributions that should have been paid, with the risk of back payments for several past years, potentially with a markup.

Some penal consequences are intentional misclassification, which is a serious offence with risks like criminal penalties, which includes fines and even imprisonment in severe cases and legal action of the individual.

The misclassified independent contractor can take legal action and claim:

- Outstanding payments such as overtime

- Payment of a notice period

- Severance payment if the termination was initiated by the company

- Lump sum indemnity of 6 months’ salary if the misclassification was intentional

Minimum wage in France

France is one of the European Union countries with the highest minimum wages, surpassed only by nations like Germany, the Netherlands, Belgium, Ireland, and Luxembourg. In France, the minimum wage is known as the SMIC.

Since 2005, the gross minimum wage per hour in France has seen a steady rise. In July of that year, it stood at €8.03. In the following 19 years, it increased by more than three euros, reaching €11.88 by November 2024.

Since 2000, average annual wages in France have steadily increased. Starting at €25,606 in 2000, wages rose to €32,409 in 2008 and €43,592 in 2023, despite a slight drop between 2019 and 2020.

Paid leave entitlement in France

From April 24, 2024, new rules in France align with EU requirements for paid leave during medical leave. The French Labour Code (Law No. 2024-364) now ensures employees accrue holiday entitlement even during sickness absence, in line with the EU Working Time Directive mandating at least four weeks of paid leave annually.

These amendments ensure fairer leave entitlements for employees during periods of medical leave, these changes include:

- All periods of illness or accident, regardless of cause or duration, entitle employees to paid leave.

- Leave accrued during non-occupational illness or accident is limited to two working days per month, up to a maximum of 24 days annually (four weeks).

- Employers must inform employees of their accrued leave and deadlines for taking it after sick leave ends.

- Employees are unable to take leave due to illness or accident and have 15 months to use their carry-over leave.

Ready to Enter the France Recruitment Market? Here’s What’s Next

Engaging contractors in a different market can be a complex matter. We get it. At Workwell Global, we simplify the process for you. With our France Employer of Record solution, we can support staffing and recruitment agencies and handle all aspects of contractor payroll, onboarding, and employment compliance.

At Workwell Global, we have a local French entity, enabling recruitment agencies to compliantly hire contractors in France without setting up their own entity. Our solution in France includes:

- The management of payments and taxes in France

- The local employment of contract and temporary workers in France

- Direct employment

- Available in-country local invoicing, on your behalf, via our French entity.

- Comprehensive professional insurance cover

- Fluent French speaking specialists, to support with administration and contractor management.

Disclaimer: The information provided here does not, and is not intended to, constitute legal advice. Instead, the information and content available are for general informational purposes only

Get in touch

If you’re ready to simplify your contractor placements, speak to our experts to find out how you can compliantly hire talent, wherever in the world they are.