If you’re thinking about entering the US market or employing remote employees in other states, Workwell Global’s data-backed approach will help you be strategically placed to access your ideal target market and talent to build your US business. We know a thing or two about the best states for business from being a specialised Employer of Record in the USA. Workwell Global has been helping businesses expand into the US for three decades, ensuring firms can hire and payroll contractors compliantly across all 50 states.

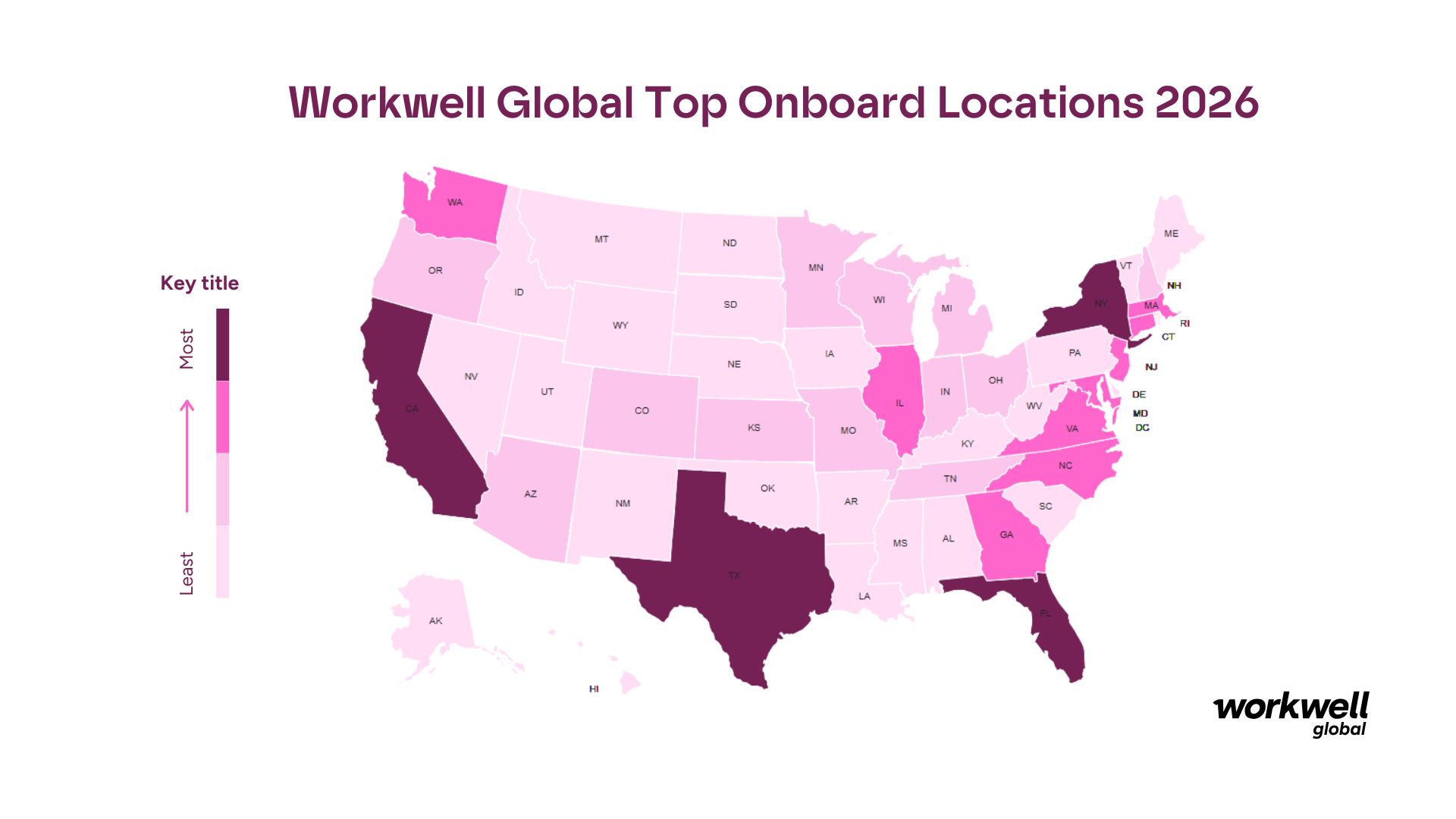

To help you out, we’ve put together this blog to give you an idea of the top states for growth in worker onboards from our clients in 2025, providing an indication of where the best states for business are in the US.

We’ll also cover:

- States that narrowly missed the top 10 Best States for Business 2026.

- Growing Popularity of South Atlantic States

- Reemergence of North Eastern States

1. California

Rank last year: #1

California remains the best state for business in 2026

For the fifth consecutive year, California ranks number one in Workwell Global’s best states for business, based on the highest number of workers onboarded by our clients in 2025.

Despite high living costs, strict employment regulations, and high-profile companies like Tesla relocating from California, businesses continue to be drawn to the Golden State. Here’s why:

The most profitable US economy

If California was a country, it would be the fifth-largest economy in the world, larger than India, the United Kingdom, and France. Yes, you read that right… California’s Gross State Product (GSP) hit $4.132 trillion in Q3 2024, making it the largest state economy in the US. Representing 14.1% of the national GDP, according to the US Bureau of Economic Analysis.

It is important to look at GDP rates when choosing an area to do business in as high rates indicate a profitable economy, and California certainly paints a profitable picture for businesses.

The number 1 talent market for tech in the US

California is home to over 39.5 million residents, which is a big contributor to why the state consistently ranks number one in terms of US employment numbers.

A considerable number of companies are hiring within California, proved by our own internal data, majorly due to the 1.8 million tech workers. According to CompTIA’s 2024 Tech Workforce Report, California remains the largest tech talent hub in the US raking up 24% of all tech employment nationwide. Home to Silicon Valley, California houses tech giants such as Apple, Google, and Meta, making it the most attractive state for tech hiring and business expansion.

Standard of higher education in California

California’s higher education system continues to play a key role in its workforce competitiveness. According to the California Community Colleges Chancellor’s Office, over 2.1 million students are enrolled in California Community Colleges, making it the largest higher education system in the US.

California’s educated workforce is further highlighted via California’s new higher education commitment to provide first time students in the state two free years of community college.

Californian companies receive highest venture capital

California remains the top state for venture capital investment. According to S&P Global, California has 347,564 private enterprises, with 24,228 backed by private equity, resulting in a penetration rate of 6.97%, the highest in any state. Yes, our data shows California as one of the top states for business to regarding employee onboards.

But we often don’t recommend the state when a company is first entering the US market due to the high costs of doing business. Less traditional states have climbed our rankings in previous years due to less strict employment laws, more business-friendly taxes and offering a lower cost of living. So, keep reading to find out the best states for business in 2026.

2. Texas

Rank last year: #2

We talk a lot about Texas at Workwell Global, mainly because we are living proof of one of the many companies that seized the benefits Texas has to offer, relocating our New York headquarters to Austin in 2020.

Texas continues to attract major companies and top talent, proving its position as one of the best states for businesses expanding into the US.

Texas remains a major player for employee onboards, due to 54 Fortune 500 companies choosing to headquarter there, and remains one of the highest counts of any state, contributing to the number of jobs available.

These large corporations drive job creation, stimulate growth across multiple industries, and consistently generate demand for skilled contractors. As a result, Texas remains the second-best state for business in 2026.

Texas has one of the lowest tax burdens in the US

Texas ranks as one of the best states for business for companies entering the US market or expanding within because it has one of the lowest tax burdens in the US. Businesses and employees can both benefit from more disposable income, thanks to the following tax rates in Texas:

- Personal income tax – 0%

- Corporate income tax – 0%

- Combined state and local sales tax –8.25%

Unlike many other states, Texas does not charge a corporate income tax, reducing operational costs for businesses. However, Texas imposes a corporate franchise tax instead of a traditional corporate income tax. The state also charges a sale and uses tax that is applied to most retail sales, leases, and taxable services.

Everything is bigger in Texas, including the talent

The saying is true; everything is bigger in Texas. As the second-largest state in the US, nearly three times the size of the UK and home to over 320 million people, Texas offers a vast market, abundant talent, and a thriving economy, making it one of the best states for business.

In recent years, Texas has become a hotspot for startups and established firms looking to scale. Additionally, companies like Meta and Tesla have relocated their headquarters to Texas, further enhancing the state’s tech landscape.

3. New York

Rank last year: #3

New York has remained 3rd place with Texas ahead in 2nd place in our best states for business list 2026. The continued back-and-forth between these two economic powerhouses highlights just how closely matched they are when it comes to business opportunities, with companies weighing factors like access to global markets, elite talent pools, and strong infrastructure.

The Most Connected US City

As we help companies from Europe and the UK enter the US market, New York is still one of the top states of choice when it comes to US business expansion, as it is one of the more straightforward locations to fly into.

New York City serves more international air travellers than any other area in the US, the most connected city in the US. This makes it perfect for business owners who need to travel both internationally and internally for business.

For example, business owners in the UK can catch a quick 7-hour flight to do business in New York City. Similarly, if you have an office in the UK or Europe, alongside operations in New York, the Eastern Standard time zone is very manageable, with a 5-hour difference.

New York has the third largest economy in the US

According to the IBIS World, New York’s Gross State Product (GSP) reached approximately $1.9 trillion in 2025, with a 2.5% growth over the last 5 years.

For comparison, according to the International Monetary Fund (IMF), Canada’s nominal Gross Domestic Product (GDP) was approximately $2.2 trillion in 2024, and Italy’s GDP was approximately $2.1 trillion in the same year. This substantial economic output underscores New York’s significant contribution to both the national and global economies.

New York stands out for business as it is the financial and cultural capital of the world. Home to Wall Street and the United Nations headquarters, it has a significant influence on international affairs and setting global trends.

Whether you own a finance, fashion, or media business, you’re sure to find not only ready to buy clients in New York, but the best talent in your industry who want to ‘make it in NY.’

New York is home to 53 Fortune 500 companies, reflecting its corporate environment and contributions to GDP output. Notable corporations headquartered in the state include:

These multinationals lure ambitious professionals and graduates to the state every year. Companies often follow workers and there is nowhere better to look than New York for a diverse, highly educated, and large talent pool to choose from to grow business.

Taxes in New York

In terms of business-friendly states, New York does not rank high. High operation costs in the form of tax rates, rent, living costs, and wages, contribute to the cost of doing business in New York. As of 2025, New York’s tax rates range from:

- Corporate income tax – 6.5% (increase to 7.25% for companies with over $5 million income)

- Personal income tax – 4% to 10.9% (higher brackets for higher incomes)

- Combined state and local sales tax – 8.875% (4% state, 4.5% city and 0.375% MCTD surcharge)

New York’s high ranking in our list of best states for business can be attributed to the excellence of financial and tech talent in the state vs the cost of doing business.

To ease the burden of doing business in New York. It is worth noting that the state does offer small business owners several incentives and tax relief to ease the burden of doing business in New York. One program worth highlighting is START-UP NY, an incentive for new companies to locate on or near universities in New York to operate tax-free.

4. Florida

Rank last year: #4

Why Florida Is One of the Best States for Business in 2026

Throughout 2025, Workwell Global have witnessed a continuous increase of worker onboards within Florida. The trend towards hiring employees in Florida shows no signs of slowing down. Florida continues to remain in 4th position in our best states for business list.

Strategic location with world class transportation routes

If you want to have a global business in an accessible area with efficient transportation routes, Florida should be at the top of your agenda when choosing an office location.

Whether you travel often for international or national client meetings, have numerous offices or need to ship or access goods, a connected location enables you to easily travel by land, sea, or air. Florida’s strategic location enables you to easily access the east coast of the US and provides a gateway to Latin America.

Florida Tax incentives

Florida boasts one of the lowest tax burdens in the US. Taxes in Florida include:

- Corporate income tax – 5.5%

- State individual income tax – 0%

- Combined state and local sales tax – 7.02%

A bright lifestyle in the sunshine state

The clue is the nickname, ‘The sunshine state’. Florida boasts 237 average days of sunshine per year, triumphing over the US average of 205 days. This tropical lifestyle has attracted talent and businesses alike, not only this, but Florida has a relatively low cost of living.

Further highlighting how Florida’s lifestyle continues to attract residents, the population grew by 2% between 2024 and 2025, bringing the total population to over 24 million, making it the 3rd most populated state in the US.

Florida’s Rising Venture Capital Investment

Florida’s venture capital scene is also thriving. In the first half of 2025, startup companies raised over $2.851 billion across 270 deals, with the Miami-Fort Lauderdale region continuing to play a key role in attracting investment, capturing $2.02 billion in 161 deals, placing Florida towards the top of the ranking for US VC activity.

With a growing talent pool and strong investor interest, it’s no surprise Florida remains one of the best states for business in 2026.

5. New Jersey

Rank last year: #5

It’s no surprise New Jersey is one of Workwell Global’s top states for business 2026. For the fifth year running it remains the 5th most popular state for worker onboards by international businesses hiring in the US. Let’s explore why this is.

Taxes in New Jersey

New Jersey has relatively high tax business rates;

- Corporate Income Tax: 6.5% to 9%

- Combined State and Local Sales Tax; 6.6%

- Individual Income Tax Rate: 10.75%

Despite the high tax rates and being in New York’s shadow (literally! you can easily view New Jersey’s skyline from Manhattan), New Jersey has everything a business needs to succeed in the US.

Access to a large business and talent market

New Jersey is in the heart of the Northeast of the US, which is home to a large and affluent market. With easy access to major metropolitan areas such as New York City and Philadelphia, businesses in New Jersey have the potential to tap into significant talent and business networks. New Jersey also has several airports, ports, and major highways, making it an ideal location for businesses that need to transport goods or travel frequently for business purposes.

Lower cost of living and rent than New York

Perhaps one of the main selling points of New Jersey is despite it having a high cost of living based on the US average, it is often more affordable for businesses than its neighbour state New York. This makes it a highly attractive option for businesses that want easy access to New York City, without the higher price tag.

New Jersey Business Funding

The New Jersey government has implemented an array of funding to help you start doing business in New Jersey over the last few years. Whether you require a loan to finance your US business expansion, are a startup looking for capital, or want to make the most of tax incentives for job creations, the state’s policies are designed to make it easier to grow a business. Some options (with eligibility criteria) include:

- Angel Investor Tax Credit Program – Establishes refundable tax credits for investors in eligibile emerging technology businesses in New Jersey.

- Aspire – A gap financing tool to support commercial, mixed-use, and residential real estate development projects.

- Catalyst R&D Voucher Program – Supports New Jersey-based start up companies to accelerate the development and innovation of technologies.

- Digital Media Tax Credit – A tax credit equal to 20-25% of qualified digital media production expenses to encourage companies to produce content in New Jersey.

- Investments in Women-Led Start-ups – An investor network to increase available capital for female-led businesses in New Jersey.

- NJ Accelerate - Incentivizes graduate companies to locate and grow in New Jersey, including a 1:1 matching loan funding up to $250,000 and rent support for up to 6 months for graduate companies.

6. Georgia

Rank last year: #8

Georgia has climbed to the number 6 spot on our best states for business list in 2026, up from 8th last year. The state continues to show steady momentum, with a 49% year-over-year increase in worker onboards. So why is Georgia becoming increasingly popular for businesses?

Business incentives in Georgia

The favourable business climate and government commitment to strengthening local workers’ skills and companies’ development are just a few of the many reasons why companies are choosing to do business in Georgia.

Taxes in Georgia include:

- Corporate state tax: 5.75%, after being lowered from 6% in 2019.

- Combined state and local sales tax: 7.38%

- Individual income tax: 5.49%

The Georgia Department of Economic Development helps businesses grow within the state, with project managers located in all 12 regions. The project managers are available for consultancy services including:

- Help with international trade to reach global markets

- Tax credits and exemptions to reward growth

- Research and market information to guide decision making.

Georgia’s skilled workforce

Companies in Georgia have access to a large talent pool. For companies that need contractors for short-term projects with quick turnaround times, Georgia’s employment laws allow things to move fast, making it one of the most business-friendly states in the US.

The median age of Georgia’s working population is lower than the US average at 37.4, with Atlanta being in the top 5 for millennials. Home to over 52K software developers, information analysts, and 44K+ engineers, Georgia is especially appealing to tech companies.

That said, Atlanta dominates Georgia’s job market, accounting for 62.13% of all job postings in the state. It’s no surprise that major corporations like Coca-Cola, The Home Depot, and Delta Air Lines, three of Georgia’s 18 Fortune 500 headquarters, call Georgia home.

Georgia’s commitment to workforce development

Georgia’s commitment to developing the local workforce is clear through their internationally acclaimed workforce training program, Georgia Quick Start.

The program provides free customised workforce training to qualified new, expanding, or locally based businesses to help them compete in the global economy. The large skilled workforce and quick start program is a win-win for companies hoping to grow by expanding to Georgia.

Reach global and US markets easily from Georgia

Georgia’s convenient location has bolstered its ranking as one of Workwell Global top states for business 2026. Domestically, companies in Georgia can access 80% of the US market within a two-hour flight time or two-day drive. For this reason alone, it is little wonder that UPS is headquartered in Atlanta.

The location also enables companies to serve the popular south-east United States, world-class ports and airports mean that global markets can be reached with ease.

7. Massachusetts

Rank last year: #7

Massachusetts has maintained its position as the 7th top state for business in 2026. Multinational businesses, including the LEGO Group, are increasingly choosing Boston as their home within the state. Here are some reasons why.

Taxes in Massachusetts

In 2022 Massachusetts introduced the new ‘Massachusetts Millionaires Tax’, where incomes over $1 million will be charged a total tax rate of 9%. For those below that threshold, the state charges a flat individual income tax of 5%, putting it in the lower half of the 50 states.

Tax rates in Massachusetts include:

- Corporate income tax – 8%

- Individual income tax – 5% to 9%

- Combined state and local sales tax – 6.25%

Travel Faster in Boston (the closest US city to London)

Businesses expanding to the US from the UK are sure to feel at home in Boston in comparison to other US cities, as it is deemed a ‘walkable’ city. It is much smaller geographically, making it more manageable for corporate travellers and those living in the city to travel around.

Boston spearheaded the way for accessible and fast transport in the US with the country’s first subway system. Boston’s public transport usage is the fourth highest in the US, with their historic system still effectively operating, making the city extremely convenient for commuters.

In addition to this, Boston is the closest US city for UK business owners travelling from London. This makes Massachusetts one of the best states for business when operating from the UK if you need to travel to the US frequently.

Access the best universities in the world in Massachusetts

Home to Massachusetts Institute of Technology, which is ranked the 2nd best university in the world for 2026 by Times Higher Education, Massachusetts has some of the best brains in business. Not to mention, Harvard University ranks number 5 of top universities globally. It is little wonder that huge companies like Liberty Mutual, Staples, and General Electric are headquartered in the state.

8. Pennsylvania

Rank last year: #13

Pennsylvania has jumped from 13th to 8th in our list of best states for business in 2026. Pennsylvania is chosen by many businesses entering the US market thanks to its strategic location in the heart of the East Coast. Here are some reasons why companies choose to do business in Pennsylvania.

A globally competitive economy in Pennsylvania

Pennsylvania would have the 19th largest economy in the world if ranked as a country and ranks 6th in the US. Home to 20 fortune 500 companies, the high calibre of higher education institutions based in the state, ensures the talent pool does not dry up for companies requiring highly educated talent.

Taxes in Pennsylvania

Pennsylvania’s tax system ranks 36th overall on the 2026 State Business Tax Climate Index. Taxes to pay when doing business in Pennsylvania include:

- Corporate income tax: Flat rate of 8.49%

- Combined state and local sales tax: 6.34%

- Individual income tax: 3.07%

Pennsylvania is located next to business powerhouse states

Located halfway between New York City and Washington, DC, you can easily reach these business powerhouse states via a quick drive or flight, while taking advantage of one of the lowest costs of living in the Northeast.

With the 6 international airports, 8 foreign trade zones, and 3 ports providing access to the Gulf of Mexico and the Atlantic Ocean, companies have confidence in the ability to trade and compete internationally when based in Pennsylvania.

Pennsylvania Business Incentives

Companies based in Pennsylvania can benefit from a range of business incentives they have to offer, these include:

- The Pennsylvania First Program: Grants or loans at a maximum of $5,000 per job for large-scale competitive “targeted industry” projects that inject significant capital investment in Pennsylvania.

- Pennsylvania Industrial Development Authority (PIDA) Loan: Businesses that commit to creating or retaining jobs in Pennsylvania may qualify for low-interest loans up to $2.25 million to contribute towards financing eligible project expenditures.

- Job Creation Tax Credit (JCTC): Businesses that create at least 25 new jobs in Pennsylvania or grow current employment by 20% are eligible for a corporate income tax credit of $1,000 per year (up to 3 years) for each new job created.

A significant government support resource worth highlighting is the Pennsylvania Business One-Stop Shop. Launched in 2018, this serves as a guide to help businesses at all stages of development in the state and connect them with all the resources they need. Their team can help you with:

- Initial Planning: Anything from business advice, writing a business plan, and choosing your structure.

- Registration: Registering your business in Pennsylvania

- Operations: Hiring workers in Pennsylvania and state taxes.

- Business Growth: Business resources and state funding.

9. Illinois

Rank last year: #9

Illinois is one of 5 states crossing the $1 trillion GDP threshold

Illinois ranks number 9 on our list of best states for business, maintaining its ranking from 2025 into 2026. Illinois is the fifth state to reach $1 trillion in annualised GDP, joining California, Texas, New York and Florida as one of the highest growing states for business in 2026.

Chicago is the main economic powerhouse contributing towards Illinois’ economic output and would rank 21st in the US if the city was a state. Chicago’s economy alone is bigger than many countries, which is a key indicator of the strength of the area for business.

Taxes in Illinois

Illinois has a flat income tax rate system and a personal income tax rate that doesn’t seem as steep as other high-profile states. Tax rates in Illinois include:

- Individual income tax: 4.95%

- Corporate income tax: 9.5%

- Combined state and local sales tax: 8.86%

Business Incentives in Illinois

A competitive range of business incentives are available to companies expanding to Illinois. Loans and grants businesses can avail of include assistance with equipment, working capital, tax credits and exemptions, and land acquisition.

Chicago is the third largest metro area in the US

The city of Chicago in Illinois is the third-largest metropolitan area in the US, providing companies with a plentiful supply of customers and employees. Chicago is centrally located in the US and connects to almost every major city across the US and internationally. If you need to travel frequently for business, Illinois could be the destination for you.

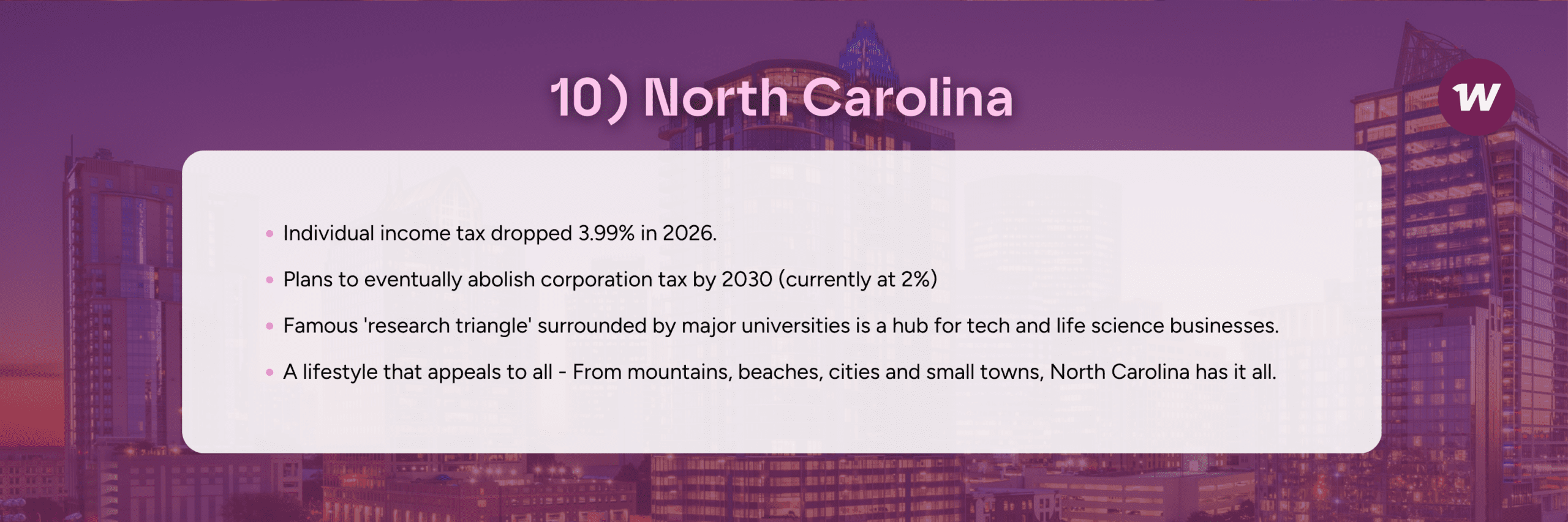

10. North Carolina

Rank last year: #6

North Carolina remains a strong performer on our list, securing a top 10 spot for another year. While it’s moved to 10th place in 2025, the state continues to attract high levels of contractor placements thanks to its thriving business environment, competitive tax structure, and growth in key sectors like tech and life sciences. With continued interest from recruitment agencies and employers alike, North Carolina firmly holds its position as one of the best states for business.

North Carolina, particularly Charlotte, has become a key destination for businesses expanding into the US, thanks to its high-quality tech talent and attractive tax incentives. Volkswagen’s Scout Motors, the American EV brand under the VW umbrella, chose Charlottle as the new corporate headquarters making a $207 million investment. In November 2025, the company and state officials announced that this is expected to create over 1.2K jobs over the next five years, making North Carolina a hot spot for businesses.

Taxes in North Carolina

North Carolina has been gradually reforming its tax system since 2013, moving from a progressive income tax model to a lower, more competitive flat rate structure. The 2026 tax rates in North Carolina are:

- Individual income tax – 3.99%

- Corporate income tax – 2%

- Combined state and local sales tax – 7%

North Carolina’s progressive tax reductions and business-friendly policies have made it one of the best states for businesses looking to expand into the US market.

Thriving Tech and Life Sciences Sectors in the ‘Research Triangle’

The Raleigh, Durham, and Chapel Hill area of North Carolina is named the ‘Research Triangle’ because of its proximity to three major research universities and has become a hub for technology and life science companies.

Raleigh is often the most sought-after area in North Carolina and is becoming one of the main east coast tech hubs of choice for companies entering the US market.

Furthermore, over 43% of North Carolina’s working population being college educated, has been a big pull for employers who want access to an educated workforce. Apple’s pledge to Raleigh by 2030 to invest $552 million in the state is proof of the progressive tech hub forming in North Carolina.

Highlighting the popularity of the Life Sciences sector in North Carolina, reported:

- There are over 840 life sciences companies in North Carolina.

- 634 of these life science companies were located in the Research Triangle region.

- There were over 100K life sciences jobs in North Carolina in 2025, a milestone for the state.

- The NC Life Sciences Apprenticeship Consortium has supported 249 individuals to date with scholarships for the BioWork course, a pre-apprenticeship program designed to launch careers in biomanufacturing.

States that narrowly missed our top 10 best state for business in 2026

Connecticut narrowly missed a spot in our top 10 best states for business for 2026, however it still deserves an honourable mention. We’ve been monitoring Connecticut’s progress closely, and it’s evident that the state is becoming an up-and-coming destination for companies seeking expansion opportunities.

In Q2 of 2025, Connecticut’s GDP witnessed a 4.6% growth, ranking 9th nationally and the fastest growing state on the East Coast. Known for its highly educated talent pool, it’s no surprise we’ve seen a 115% rise in contractor placements.

With growing demand for skilled professionals and a supportive business climate, Connecticut is quickly becoming one of the best states for business to keep on your radar.

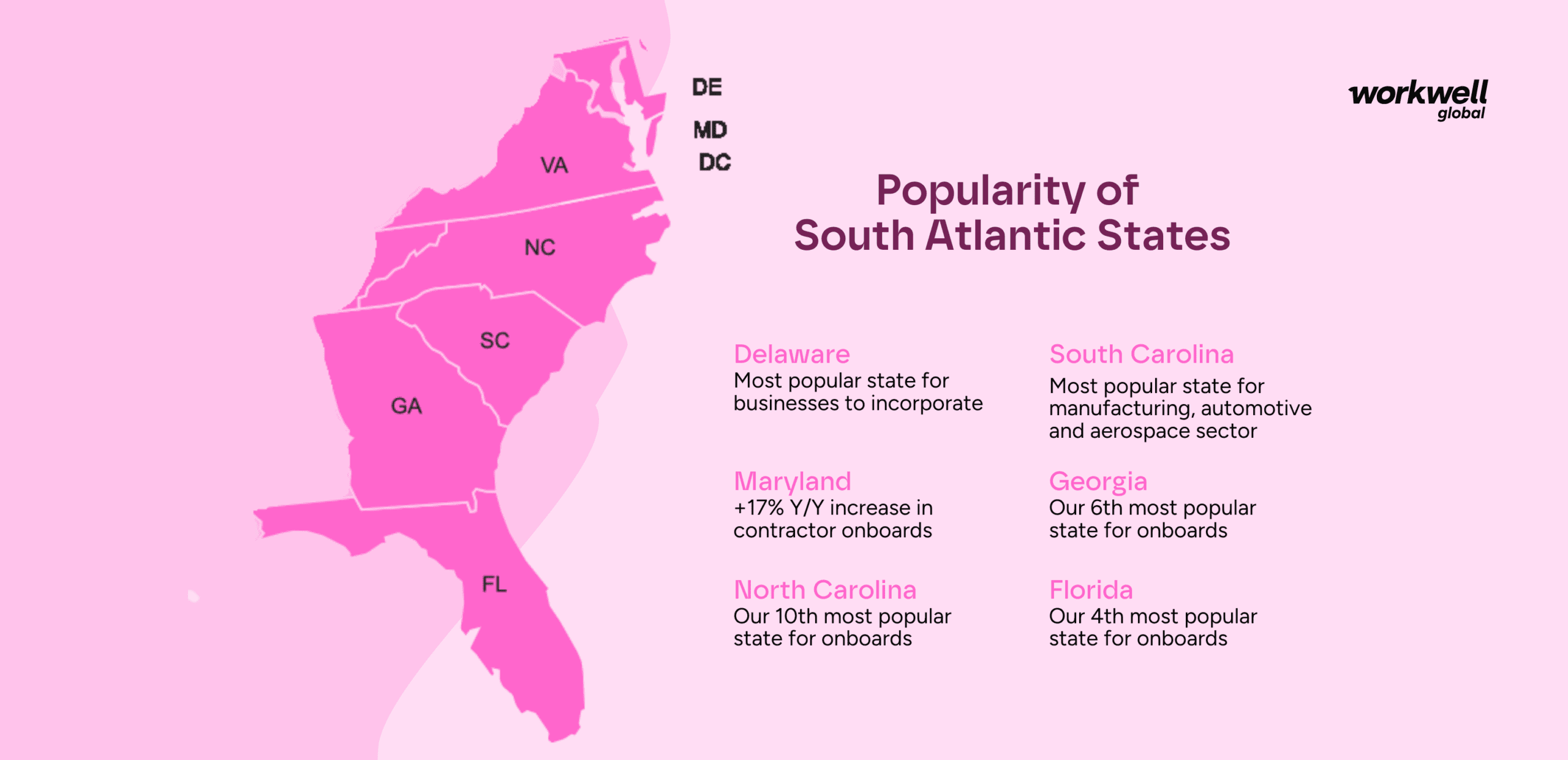

Growing Popularity of South Atlantic States

The South Atlantic states have seen a notable surge in their popularity as top locations for businesses in the aftermath of COVID-19. This region, which includes Delaware, Florida, Georgia, Maryland, North Carolina, South Carolina, Virginia, and West Virginia, has become increasingly attractive to businesses of all sizes, from startups to multinational corporations.

This increase in popularity is reflected in our data, with three South Atlantic states, Florida, Georgia and North Carolina featured in our top 10 list of best states for business in 2026.

One of the primary drivers of this influx has been the competitive economic landscape that the South Atlantic states offer. Many of these states boast lower corporate tax rates and provide generous incentives for businesses to establish or expand their operations.

The quality of life in the South Atlantic region is a compelling draw for businesses and their workers alike. The area is known for its mild climate, diverse cultural offerings, and access to both the Atlantic coastline and mountainous landscapes, providing a balance between work and leisure that is increasingly valued in today’s business world.

The significant net domestic migration into the South Atlantic states post-COVID-19 is both a cause and effect of their growing appeal as business destinations.

Where is the talent migrating to in 2026?

According to the Visual Capitalist, the southern Atlantic states which are showing the highest growth and shifts in population between 2025 to 2050 are:

- Texas: +8.55 million (+27%)

- Florida: +5.15 million (+22%)

- Georgia: +1.7 million (+15%)

- North Carolina: +1.17 million (+11%)

- Virginia: +890K (+10%)

This steady population influx strengthens the workforce, fuels economic expansion, and reinforces why these states remain some of the best for business in 2026.

With their strategic location, offering easy access to domestic and international markets, and ongoing investments in infrastructure, the South Atlantic states are poised to remain a regular fixture in our list of best states for business.

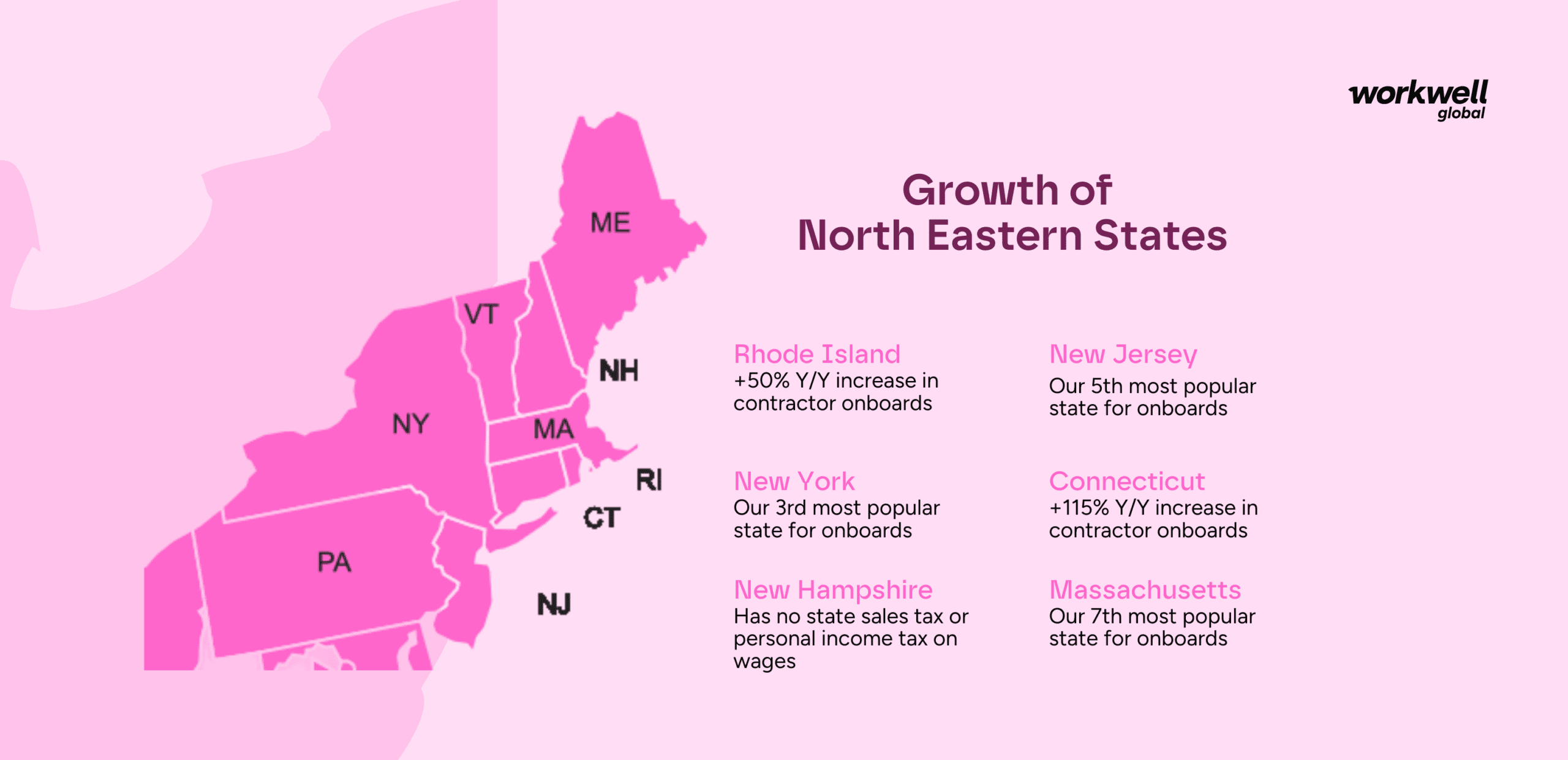

Reemergence of North-Eastern States

The reemergence of North-Eastern states as popular locations for businesses marks a significant turnaround from the trends observed in the aftermath of the COVID-19 pandemic.

During the pandemic, these states experienced substantial net domestic migration outflows, as businesses and individuals moved to states with lower costs of living, less stringent regulations, and more favourable climates.

Meanwhile, Maryland and Connecticut all witnessed growth outside of the top 10 states for business 2025. The North-East remains a strategic location along the Eastern seaboard offering access to some of the largest markets in the United States and Canada.

As working trends have changed over these last few years, some workers are now skewing away from remote work, which may be a factor in the resurgence of these states.

The North-Eastern states are well-positioned to solidify their status in our list of best states for business in the United States

Ready to Select a State to do Business in?

When entering the US market or relocating states, it’s important to remember that each state differs in employment laws, time zones, taxes, minimum wages, sector demand, culture, and cost of living.

To ensure you are best positioned to grow your business in the US, complete market research before deciding which state will best support your requirements.

The states highlighted above don’t reflect the entire US workforce, but instead represent a high-level view of Workwell Global’s onboarding data from our clients.

If you're looking to expand your business into or within the US, we can help you identify the best states to hire in your sector and ensure full compliance when hiring US workers. Book a call with one of our US expansion experts to find out how you can easily start doing business in the US.

Disclaimer: The information provided here does not, and is not intended to, constitute legal or accountancy advice. Instead, the information and content available are for general informational purposes only.