The Netherlands is one of the most attractive staffing markets globally, and a top destination for Workwell Global clients placing contractors. According to Staffing Industry Analysts (SIA), the Dutch staffing industry is projected to reach $23.7 billion in 2025, with a steady 2% year-on-year growth through to 2030.

The Netherlands is the fourth largest temporary staffing market in Europe and is a well-established, in demand market with strong business opportunities for expansion.

For recruitment agencies, there is a significant opportunity to increase and diversify revenue by placing workers in this popular staffing market. But navigating payroll in the Netherlands requires a deep understanding of local regulations, worker classifications, and compliance risks.

That’s why we’ve created this guide from a recent webinar with Ronald Vermeulen, Compliance Consultant at Workwell Global, to help recruitment agencies operate compliantly in the Netherlands.

In this blog, we will cover:

Key Sectors Driving Hiring Demand in Netherlands

Types of Employment Contracts in the Netherlands

Dutch Labor Laws

Dutch Licensing Requirements

Key Sectors Driving Hiring Demand in the Netherlands

Recruitment agencies looking to manage payroll in the Netherlands will find a strong demand across several high-growth sectors. These industries are not only expanding rapidly but also facing talent shortages, creating prime opportunities to make contractor placements, as explained in a section of our Netherlands webinar below.

Listen below to hear our Managing Director, Amy Davies dive deeper into some of the opportunities in the Dutch market.

Technology

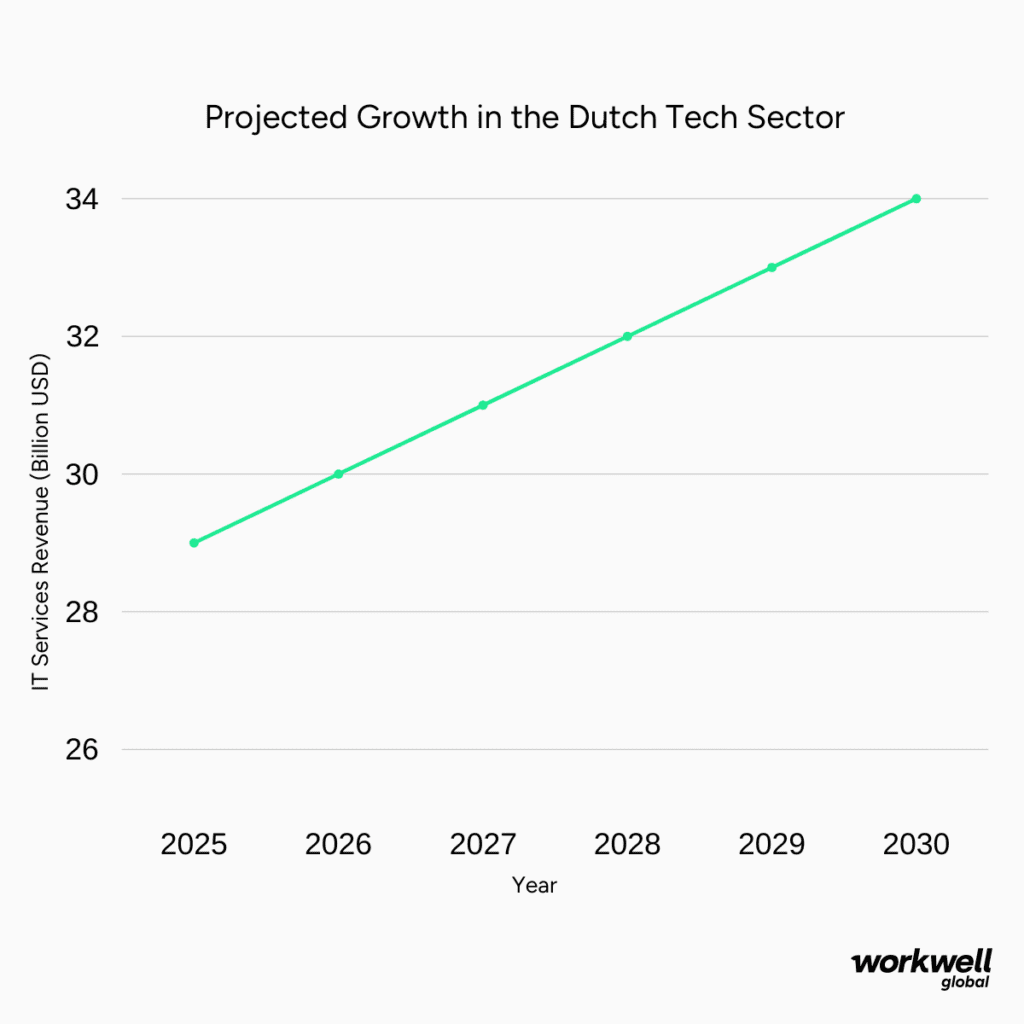

The Dutch tech sector is booming, with rapid growth projected in the years ahead. According to Statista, IT services revenue in the Netherlands is expected to reach $28.71 billion by the end of 2025, climbing to $34.00 billion by 2030. Despite a steady inflow of talent, the industry is on track to face a labor shortage of 105,000 professionals. Presenting an opportunity for recruitment agencies to help business in the Netherlands find IT talent.

In 2025, tech, IT support and operations roles are among the top hiring priorities for Dutch companies, ranking third overall in demand according to Robert Half’s Salary Guide. Closely followed by roles in AI and machine learning. For recruitment agencies placing contractors in the Netherlands, the Dutch tech sector offers one of the most dynamic and high-growth opportunities

Accounting and Finance

The Netherlands’ accounting sector plays a crucial role in the country’s economy, contributing significantly to its services industry. So much so that it is considered to be one of the fastest growing hubs in Europe for finance innovation.

In 2025, the Netherlands accounting industry was valued at €14.6 billion, employing 78,578 professionals across 37,407 businesses. The broader services sector, which includes finance and accounting, accounted for 77% of the Netherlands’ total economic output by 2023. Highlighting the sectors high demand for contractor placement.

Renewable Energy

The Dutch government aims to reach zero carbon emissions by 2050, driving investment in wind, solar, and hydrogen, as well as innovative solutions to reduce energy consumption. This transition is driving a demand for skilled professionals in this industry creating new opportunities for recruiters in this sector, including 125,000 new jobs in horticulture and climate-friendly food production and innovation.

We have already seen firms in this space performing well. A standout example is Brunel, a Dutch based global energy staffing firm, who reported revenue of €346.3 million in the second quarter of 2024, marking a 6% year-over-year increase according to Staffing Industry Analysts.

Types of employment contracts in the Netherlands

When placing contractors in the Netherlands, it’s essential for recruitment agencies to understand the distinction between independent contractors and employees, under the Dutch employment law.

Independent Contractors

Independent contractors in the Netherlands typically fall into two categories:

- BV (Besloten Vennootschap): Contractors operating through their own limited company or partnership

- ZZP’ers (Zelfstandige Zonder Personeel): Sole proprietors, the most common form of self-employment

The term “ZZP’er” is widely used instead of “independent contractor.” For UK-based recruitment firms, it’s perfectly acceptable to engage sole proprietors in the Netherlands. Many contractors choose the ZZP’ers route due to its simplicity and lower setup costs compared to forming a BV.

Employees

Employment contracts in the Netherlands are classified into three main types, determined by Dutch employment law:

- Regular Employment Contracts: The standard form of employment

- Temporary Work Contracts: Used for agency workers, with additional flexibility for employers under the Temporary Work Regime.

- Payrolling Contracts: Unique to the Dutch market, these refer to outsourced employment solutions provided by agencies. Unlike UK payroll, this model involves the agency acting as the legal employer while the worker operates under the client’s supervision

Understanding these contract types is crucial for ensuring classification and compliance when placing talent in the Dutch market.

Understand Worker Classification in the Netherlands

Worker classification has been a complex issue in the Netherlands for over a decade. The DBA Act was introduced to help distinguish between employees and independent contractors, using model agreements pre-approved by the Dutch tax office. These agreements offered protection against reclassification, as long as the contractor performs services exactly as described.

However, enforcement of the DBA was paused shortly after its introduction. That changed on January 1st, 2025, when the Dutch government resumed policing. This led to a noticeable drop in new contractor registrations, especially in sectors like healthcare, where confusion around classification remains high.

VBAR Legislation

The proposed VBAR legislation aims to clarify contractor classification. It phases out model agreements and shifts responsibility to clients and contractors to prove their independence.

A major change is the presumption of employment. Contractors in the Netherlands earning under €33/hour may claim employment rights unless independence is proven. This proposal is still under review in Parliament, but parts may be implemented soon.

With enforcement tightening and legal standards evolving, recruitment agencies must take proactive steps to ensure compliance. Misclassification can lead to fines, back taxes, and reputational risk, making classification a critical part of managing payroll in the Netherlands.

Understand and Remain Compliant With Netherlands Labor Laws

Navigating the Dutch contract market means more than just placing talent, it requires a solid grasp of local labor laws. Two key areas agencies must pay close attention to are the Chain Law, which governs liability across the supply chain, and a G account, is a blocked bank account that banks only open upon approval from the Tax Office.

Watch the video below where we discussed in our webinar how to stay compliant under Netherlands labor.

Chain law

In the Netherlands, employment reclassification isn’t the only risk agencies face, there’s also the Chain Law. This law holds every party in the supply chain liable for any unpaid taxes and social security contributions. So, if an agency places a contractor with a client, both the agency and the client can be held responsible if taxes go unpaid.

G-account

To manage this risk, Dutch clients often require agencies to use a G account. A G account is a blocked bank account used solely to pay taxes and social security contributions to the Dutch government. Clients may deposit up to 40% of the invoice into this account to protect themselves from liability under Chain law.

For more insights and to gain a better understanding of the legalities under the Netherlands labor law, catch up on the full webinar here.

Licensing Requirements to Place and Payroll in the Netherlands

What is a WAADI check and registration?

For recruitment agencies looking to place and payoll in the Netherlands, understanding the WAADI Act is essential. WAADI governs labor leasing, defined as supplying workers to a client who directs and supervises their work.

If your agency is involved in labor leasing, you must be registered with the Dutch Chamber of Commerce, regardless of whether you’re based in the Netherlands or abroad.

Gain a better understanding of a WAADI check and its complexities in this short snippet below.

If you fail to register with the Dutch Chamber of Commerce, this can result in non-compliance penalties. Dutch clients are increasingly cautious and will expect agencies to meet WAADI obligations before engaging contractors.

Dutch Regulation Changes and Who Needs a License

The Dutch government is preparing to introduce a licensing requirement for labor leasing agencies, aimed to improve the tansparency and preventing worker exploitation. The Ministry of Social Affairs and Employment has been designated to be responsible for the licensing process.

Importantly, agencies placing independent contractors (ZZP’ers) do not need a license, but only if those contractors are truly self-employed. If a contractor is misclassified and deemed an employee, your agency could be considered to be labor leasing without a license, which may result in significant fines.

For recruitment firms, this means taking extra care with classification and documentation. As the licensing regime approaches, compliance will become a key differentiator in the Dutch staffing market.

Licensing Requirements for Labor Leasing in the Netherlands

To operate legally in the Dutch labor leasing market, agencies will need to meet strict licensing criteria. Here are the key compliance steps and penalties to be aware of:

Ready to Place and Payroll in the Netherlands with Workwell Global?

Engaging contractors in a different market can be a complex matter. We get it. At Workwell Global, we simplify the process for you. With our Netherlands Employer of Record solution, we can support staffing and recruitment agencies and handle all aspects of contractor payroll, onboarding, and employment compliance.

Whether you’re engaging employed workers or self-employed contractors, our tailored solutions ranging from Employer of Record (EOR) and Agent of Record (AOR) are built on years of experience working with staffing and recruitment firms worldwide.

If you found this guide useful or if you’re ready to simplify your contractor placements, watch our full webinar here or speak to our experts to find out how you can compliantly hire talent, in the Netherlands.

Ready to Place and Payroll in the Netherlands Contract Market?

Book a call with one of our employment experts to find out how we make placing and payroll contractors in the Netherlands, work for you

Latest resources

3 Steps for Hiring Global Talent with Confidence

Hiring global and remote talent opens up incredible opportunities, but it also comes with its own set of challenges. We…

Your Guide for a Successful Global Business Expansion

Businesses that break into new markets don’t just grow, they lead. Global business expansion is a differentiator that helps thriving…

How to Grow a Recruitment Business in New Markets from the UK

From remote expansion strategies to leadership lessons and scaling smartly in tough markets, this article is packed with insights that…