Compliance Regulations When Placing Contractors Across Europe

Learn why staying compliant whilst placing contractors across Europe is important.

SERVICES

Workwell Global is Europe’s premier provider of industrial and offshore payroll services, offering a fully compliant solution to engage blue and grey-collar workers.

Managing payroll in construction, oil & gas, and other blue and grey-collar industries is about compliance, financial security, and operational efficiency. Workwell Global ensures fast, reliable, and risk-free payroll management by using our own legal entities, enabling direct tax authority access and eliminating third-party risks.

Unlike many providers, we only payroll through our own legal entities. Why is this important?

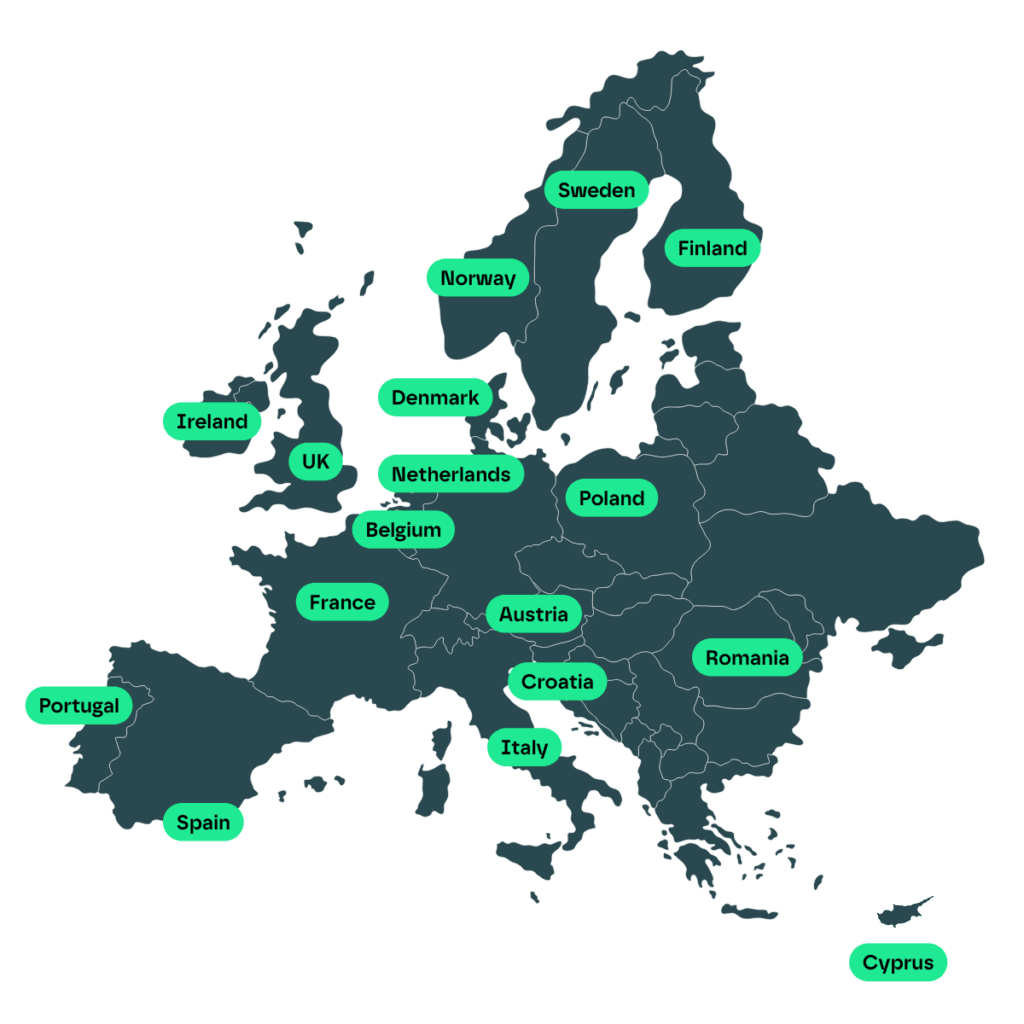

Engage workers compliantly and confidently through our registered local entities in Europe. We offer services in:

Workwell Global can help you engage blue and grey-collar workers across a number of complex markets.

Learn MoreAt Workwell Global, we ensure that every payroll process is structured to protect staffing agencies, end-clients, and workers alike.

We finance contractor payroll to ensure you receive wages on time, even before the agency or client pays us.

No surprises. We ensure you are fully compliant, avoiding tax issues down the line.

Occupational hazard insurance, liability coverage, and local legal protections are included.

For non-EU workers, we handle sponsorships and compliance.

You sign a compliant employment agreement with Workwell Global.

We manage payroll, taxes, and compliance - you focus on your work.

We ensure timely payments every month – no delays, no stress.

A CBA is an agreement between employers or employer groups and trade unions, setting mandatory employment terms like pay rates, working hours, and conditions. Adhering to CBAs ensures compliance, prevents legal repercussions, fines, worker grievances, and operational disruptions.

We provide detailed, in-house payroll simulations before onboarding. These enable you to forecast total labour costs, including gross wages, employer contributions, and tax obligations – ensuring budget predictability and helping businesses avoid unexpected payroll costs.

We cover employer obligations, including occupational hazard insurance and liability protections.

Our local tax registrations mean we can process payments and compliance requirements faster than third-party providers.

By partnering with us, clients can focus on project execution while we handle the complex payroll and compliance landscape.

Many clients require invoices to come from a locally registered entity. We solve this by invoicing through our own 18 European entities, ensuring full compliance.

Agencies often struggle with delayed client payments. We solve this by paying contractors upfront while waiting for the client’s funds, helping agencies manage cash flow effectively.

Our MSA ensures that employer obligations are clearly defined, so agencies aren’t left exposed to legal or financial risks.

Our in-house team is available to explain the agreement to agencies, clients, and contractors, removing confusion and reducing disputes.

Learn why staying compliant whilst placing contractors across Europe is important.

In this forecast, we analyse key staffing industry trends, market sizes, and predictions for the year ahead.

If you’re thinking about entering the US market or employing remote employees in other states, Workwell Global’s data-backed approach will…