Each year brings significant changes to the US labor and employment landscape, and 2025 was no exception, from a new presidential administration to growing trends in paid family and medical leave programs, neonatal and other leave entitlements, and artificial intelligence.

As a USA Employer of Record, Workwell Global is here to help guide you through the ever-evolving landscape of US employment laws with our latest round of updates for 2025. We hope this guide on US employment laws for 2025 will help your business be prepared for any changes and their impacts.

Please note, the following is a brief list of labour and employment laws for 2026. If you are an existing client of Workwell Global, please reach out to your Business Manager for an extensive, detailed list of important updates stored in our Client Toolkit!

What US Employment Law Updates are Included in This Blog?

- 2025 Federal and State-Level Updates

- 2026 Federal Updates

- 401(k) Updates

- Healthcare and Benefits Updates

- Federal Action on Artificial Intelligence Regulation

- State-by-State Updates

Key US Employment Law Updates: Q3-Q4 2025

The second half of 2025 brought significant changes to US employment law at both the federal and state level. With a new presidential administration in place, employers saw major developments affecting federal tax policy, immigration, AI in hiring, workplace safety, leave entitlements, and pay transparency.

Federal Employment Law Updates

One Big Beautiful Bill Act (OBBBA)

Signed into law on July 4, 2025, the One Big Beautiful Bill Act introduced sweeping tax changes impacting both workers and employers. A major provision allows employees to deduct certain overtime pay from their taxable income for tax years 2025–2028.

Under the Act, workers may deduct the portion of overtime pay that exceeds their regular hourly rate (the “half” portion of time-and-a-half pay) when that overtime is required by the Fair Labor Standards Act (FLSA). The deduction is capped at $12,500 annually ($25,000 for joint filers) and phases out for higher earners.

Importantly for employers, only FLSA-mandated overtime qualifies—overtime required solely by state law does not. Employers must report qualified overtime compensation, although the IRS confirmed it will not penalise employers for failing to separately report this amount for tax year 2025.

H-1B Visa Restrictions

In September 2025, a new presidential proclamation introduced a $100,000 fee for new H-1B visa petitions filed after September 21, 2025, including petitions submitted for the 2026 lottery. The rule does not apply to extensions, amendments, or changes of status for individuals already in the US. Legal challenges are ongoing, with early rulings expected before the March 2026 lottery.

End of Automatic EAD Extensions

An interim final rule issued by the Department of Homeland Security in October 2025 ended the automatic extension of Employment Authorization Documents (EADs) for most renewal applicants. Automatic extensions of up to 540 days no longer apply to applications filed on or after October 30, 2025, with limited exceptions for certain protected statuses.

State and Local Employment Law Changes

California: Regulation of AI and Automated Decision Systems

Effective October 1, 2025, California introduced final rules regulating automated decision systems (ADS) in employment. Employers with five or more employees may not use AI-driven tools that discriminate against applicants or employees based on protected characteristics.

The rules apply to technologies such as résumé screening software, targeted job ads, algorithmic assessments, and interview analysis tools. Employers must provide reasonable accommodations for applicants with disabilities or based on religious creed. Notably, third-party vendors may also face liability for discriminatory AI systems.

Illinois: Warehouse Tornado Preparedness

The Illinois Warehouse Tornado Preparedness Act took effect on December 13, 2025. Covered warehouse operators must implement site-specific tornado safety plans, coordinate with local emergency services, and file plans with relevant fire and emergency management authorities.

Maryland: Expanded Parental Leave Rights

Maryland amended its Parental Leave Act effective October 1, 2025. Employers with 15–49 employees must now provide up to six weeks of unpaid parental leave for birth, adoption, or foster placement. This amendment clarifies that the Act does not apply to employers covered under the federal Family and Medical Leave Act for the year.

Ohio: Expanded Anti-Discrimination and Pay Transparency

Cuyahoga County expanded its CROWN Act protections in November 2025, explicitly covering discrimination based on hair texture and hairstyles associated with race or national origin.

In Columbus, amendments to the city’s salary transparency law now require employers with 15 or more employees to include a reasonable salary range in job postings. While enforcement begins in 2027, employers are encouraged to prepare now—particularly for remote roles.

Pennsylvania: Broader Anti-Discrimination Protections

Pittsburgh updated its anti-discrimination ordinance effective December 10, 2025, extending protections to individuals based on both actual and perceived membership in protected classes. Newly clarified protections include hair texture, immigration status, preferred language, housing status, and medical marijuana patient status.

Key US Federal Employment Law Updates for 2026

As employers prepare for 2026, several federal employment, payroll, benefits, and compliance thresholds have been updated. These changes affect overtime classification, retirement contributions, healthcare affordability, and the evolving regulatory landscape for artificial intelligence in the workplace.

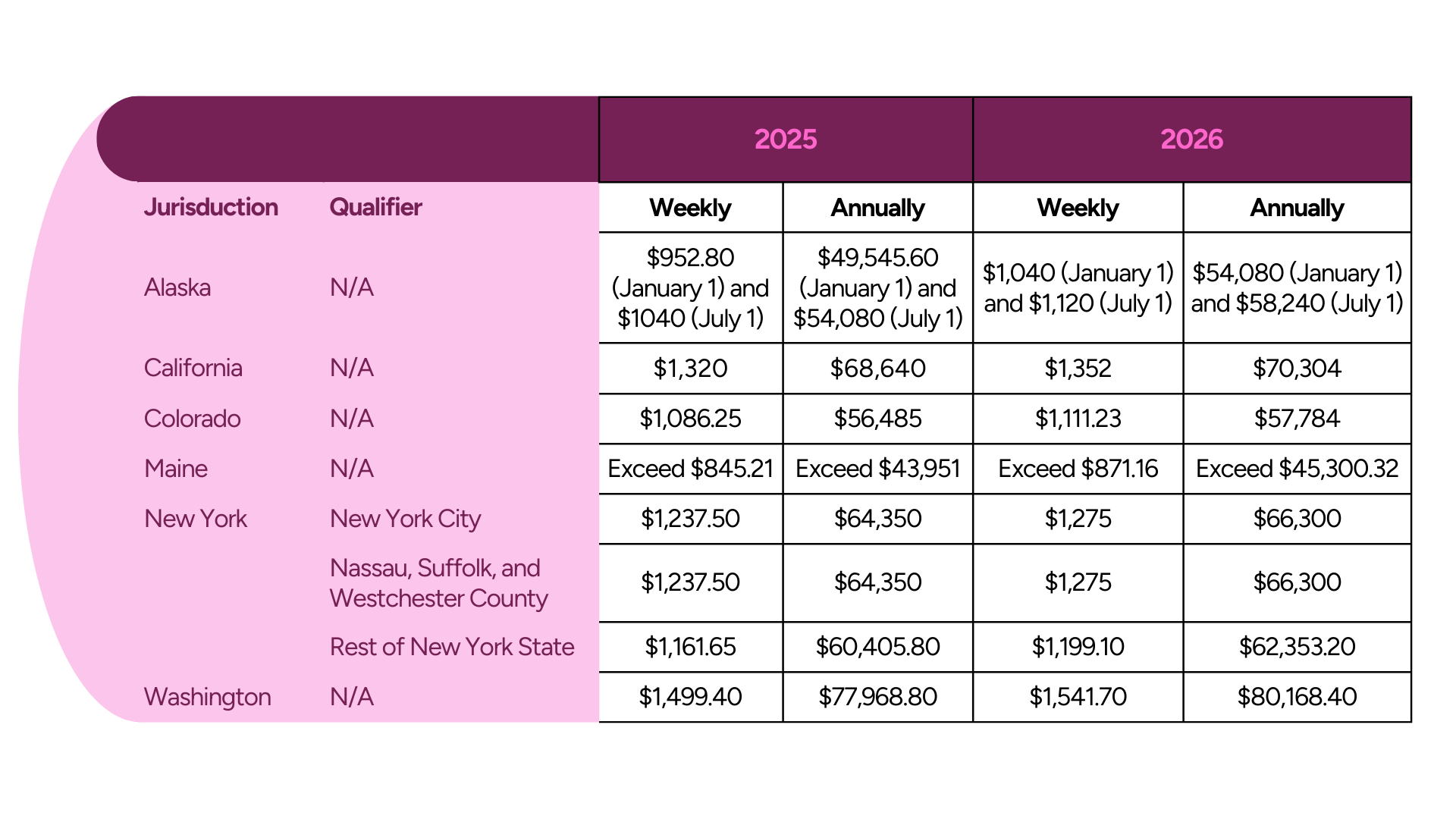

Overtime Exemption Salary Thresholds

Under the Fair Labor Standards Act, employees must generally earn at least $684 per week ($35,568 annually) to qualify for exemption from overtime pay, subject to limited exceptions.

While the federal threshold remains unchanged for 2026, several states and local jurisdictions have implemented higher exemption salary requirements, which take precedence over federal law. Employers with workers in impacted jurisdictions should review classifications carefully to ensure continued compliance.

Computer Employee Exemption Updates

For 2026, multiple states increased the minimum pay required to classify computer employees as overtime-exempt:

- California: $58.85 per hour or $122,573.13 annually

- Colorado: $34.85 per hour

- Washington: $59.96 per hour

These thresholds apply regardless of federal exemption standards and may require salary adjustments or reclassification.

Highly Compensated Employee (HCE) Thresholds

Colorado increased its highly compensated employee exemption for 2026. The annual compensation threshold rose from $127,091 in 2025 to $130,014 in 2026, impacting exemption eligibility for certain senior or specialized roles.

Retirement and Savings Plan Updates for 2026

401(k) Highly Compensated Employee Threshold

For retirement plan purposes, the federal definition of a highly compensated employee remains unchanged. Employees earning $160,000 or more will continue to be treated as HCEs for 2026 when assessing plan nondiscrimination rules.

Traditional 401(k) Contribution Limits

Employee contribution limits increased for 2026:

- Standard contribution limit: $24,500 (up from $23,500 in 2025)

- Catch-up (age 50+): $8,000 (up from $7,500)

Under SECURE 2.0, enhanced catch-up contributions remain available for employees aged 60–63. For 2026, the higher catch-up limit stays at $11,250.

Roth IRA Contribution Updates

Roth IRA contribution limits also increased:

- Standard contribution limit: $7,500

- Catch-up (age 50+): $1,100

Unlike some retirement limits, IRA catch-up contributions are not automatically adjusted annually, making this increase particularly notable for older workers.

Health and Benefits Compliance Changes

Health Savings Account (HSA) Contribution Limits

Federal inflation adjustments increased HSA contribution caps for 2026:

- Self-only coverage: $4,400

- Family coverage: $8,750

These updated limits apply regardless of employer contribution levels.

Affordable Care Act (ACA) Affordability Threshold

The Affordable Care Act affordability threshold will increase to 9.96% of household income for plan years beginning in 2026, up from 9.02% in 2025. This threshold determines whether an employer’s lowest-cost health plan meets ACA affordability requirements and may affect employer shared responsibility penalties.

Federal Action on Artifical Intelligence Regulation

Executive Order on National AI Policy Framework

On December 11, 2025, President Trump issued an Executive Order aimed at establishing a single national framework for artificial intelligence regulation, challenging the growing patchwork of state AI laws.

The Order emphasizes reducing regulatory burdens on AI development and explicitly references concerns with state-level AI laws, including Colorado’s. It directs senior federal advisors to develop legislative recommendations that would preempt conflicting state AI regulations.

The Order also mandates the creation of an AI Litigation Task Force within the Department of Justice to challenge state AI laws deemed inconsistent with the forthcoming federal framework.

State-by-State Employment Law Updates:

- California

- Colorado

- Connecticut

- Delaware

- Illinois

- Maine

- Maryland

- Minnesota

- New York

- Oregon

- Pennsylvania

- Washington

California

Expanded Sick and Safe Leave Uses

Effective: January 1, 2026

California has expanded the permitted uses of paid sick and safe leave. Employees may now use paid or unpaid safe leave if they or a family member are victims of certain crimes and are attending related judicial proceedings. Paid sick leave may also be used when an employee appears in court as a witness pursuant to a subpoena, serves on a jury, or is otherwise required to attend court proceedings related to a crime.

Pay Data Reporting Amendments (FEHA)

Effective: January 1, 2026 (additional changes January 1, 2027)

California amended its pay data reporting rules under FEHA. Covered employers and labor contractors must store demographic data separately from personnel records beginning January 1, 2026. Effective January 1, 2027, the number of reportable job categories will expand from 10 to 23.

San Francisco – Health Care Security Ordinance (HSCO)

Effective: January 1, 2026

For employers with 100 or more employees nationwide, San Francisco’s required healthcare expenditure rate increases to $4.11 per hour. The ordinance also raises the compensation threshold exempting managerial, supervisory, and confidential employees to $128,861 annually (or $61.95 per hour).

Prohibition on Stay-or-Pay and Training Repayment Provisions

Effective: January 1, 2026

California enacted a new law prohibiting most repayment, retention, and stay-or-pay provisions tied to the end of employment. Employers may not require repayment of training costs, immigration expenses, recruitment fees, or similar “debts” upon termination, subject to narrow exceptions. Existing agreements are not impacted.

Pay Transparency Clarification

Effective: January 1, 2026

California clarified that a “pay scale” means a good-faith estimate of the salary or hourly wage reasonably expected to be paid at hire. Employers with 15 or more employees must include pay scales in all job postings.

Data Security Breach Notification Amendments

Effective: January 1, 2026

Businesses must notify affected individuals of data breaches within 30 calendar days of discovery. If a breach affects more than 500 California residents, the Attorney General must also be notified within 15 days of consumer notification.

CCPA – Automated Decision-Making Technology (ADMT)

Effective: January 1, 2026

Employers subject to the CCPA that use automated decision-making technology for significant employment decisions must complete risk assessments, provide pre-use notices, allow opt-outs in certain cases, and offer access rights explaining how ADMT was used.

Colorado

Paid Family and Medical Leave (FAMLI) – NICU Leave

Effective: January 1, 2026

Colorado’s FAMLI program adds up to 12 additional weeks of paid leave for employees whose infant is receiving inpatient care in a neonatal intensive care unit. This leave is separate from bonding leave and does not reduce other FAMLI entitlements.

Colorado Artificial Intelligence Act (CAIA)

Effective: June 30, 2026

Colorado enacted one of the most comprehensive AI laws in the US. Developers and deployers of high-risk AI systems used in employment decisions must prevent algorithmic discrimination and comply with extensive disclosure, reporting, and impact-assessment requirements.

Connecticut

Paid Sick Leave Expansion

Effective January 1, 2026

Connecticut’s paid sick leave law expands to employers with 11 or more employees in the state. Eligible employees may accrue and use up to 40 hours of paid sick leave per year.

Delaware

Paid Family and Medical Leave Insurance Program

Effective: January 1, 2026

Under the Healthy Delaware Families Act, eligible employees may take up to 12 weeks of paid family and medical leave, receiving up to 80% of wages (capped at $900 per week). Employers are responsible for funding the program, with contributions dependent on employer size.

Illinois

Paid Lactation Breaks

Effective: January 1, 2026

Illinois now requires employers with five or more employees to pay employees for lactation break time at the employee’s regular rate of pay. Previously, such breaks were required, but as unpaid time. Employees cannot be required to use paid leave for this purpose.

Restrictions on AI in Employment Decisions

Effective: January 1, 2026

Illinois amended its Human Rights Act to prohibit the use of AI that results in discrimination or uses proxies such as ZIP codes. Employers must also notify employees when AI is used in hiring, promotion, discipline, or other employment decisions.

Organ Donation Leave Expansion

Effective: January 1, 2026

Paid organ donation leave now applies to part-time employees, allowing up to 10 paid days in a 12-month period.

Neonatal Intensive Care Leave Act (NICLA)

Effective: June 1, 2026

Eligible employees may take unpaid NICU leave while their child is receiving neonatal intensive care—up to 10 or 20 days, depending on employer size. Leave is job-protected and health benefits must be maintained.

Maine

Paid Family and Medical Leave Program

Effective: May 1, 2026

Maine’s PFML benefits begin, allowing employees to take up to 12 weeks of paid leave per year for family or medical reasons. Payroll contributions began in 2025.

Maryland

Paid Family and Medical Leave Delay

Effective: Contributions delayed to January 1, 2027

Maryland delayed both employer and employee contributions and the availability of paid leave. Benefits will begin no earlier than January 1, 2027, and no later than January 1, 2028.

Baltimore – Pregnancy Accommodation Ordinance

Effective: January 10, 2026

Baltimore employers with 2 or more full-time employees must provide reasonable pregnancy-related accommodations and maintain a written pregnancy accommodation policy distributed to employees.

Minnesota

Paid Family and Medical Leave

Effective: January 1, 2026

Minnesota’s PFML program launches, offering eligible employees up to 20 weeks of paid family and medical leave per year. The premium rate is 0.88%, shared between employers and employees.

New York

New York LLC Transparency Act

Effective: January 1, 2026

Certain LLCs must report beneficial ownership information to the New York Department of State. Existing LLCs must file by December 31, 2026; newly formed LLCs must file within 30 days. Exempt LLCs must file an attestation of exemption with the same deadlines, on an annual basis.

NYC Earned Sick and Safe Time Act Amendments

Effective: February 22, 2026

NYC expanded permissible uses of sick and safe leave and now requires employers to provide 32 hours of unpaid sick or safe leave annually, in addition to paid entitlements.

Oregon

Paid Sick Leave for Blood Donations

Effective: January 1, 2026

Oregon allows employees to use paid sick leave for blood donations made through approved or accredited programs.

Workplace Violence Prevention – Healthcare Employers

Effective: January 1, 2026

Healthcare employers must update workplace violence prevention plans and provide annual training to employees and contracted security staff.

Pennsylvania

Pittsburgh Paid Sick Leave Amendments

Effective: January 1, 2026

Accrual increases to 1 hour per 30 hours worked. Annual caps rise to 72 hours for employers with 15 or more employees and 48 hours for smaller employers.

Philadelphia Fair Criminal Record Screening Amendments

Effective: January 6, 2026

Philadelphia expanded “Ban the Box” protections, requiring provisional written decisions, detailed notices, and a 10-business-day response period before final adverse action.

CROWN Act Amendments

Effective: January 24, 2026

Pennsylvania now explicitly prohibits discrimination based on hair texture or protective hairstyles associated with race.

Washington

Leave and Accommodations for Hate Crime Victims

Effective: January 1, 2026

Washington expanded protected leave and safety accommodations to include victims of hate crimes, including those committed online.

Non-Compete Salary Threshold Increase

Effective: January 1, 2026

Non-compete agreements are unenforceable against employees earning less than $126,858.83 annually and contractors earning less than $317,147.09 annually.

Fair Chance Act Amendments

Effective: July 1, 2026 (large employers – 15+ employees); January 1, 2027 (all employers)

Washington further restricts criminal history inquiries, bans automatic disqualifiers, and limits adverse actions based on arrest or juvenile records.

Got Questions About US Employment Law?

Keeping up with US employment law can be complex and time-consuming. Businesses face the challenge of navigating a myriad of regulations while trying to stay focused on growth.

That’s where Workwell Global makes it work for you. From onboarding to payroll, expenses, insurance, and benefits, we take care of the details compliantly, in accordance with the latest regulations.

With decades of experience as a trusted Employer of Record in the US, we specialise in simplifying workforce management for businesses looking to enter the US market. Whether you wish to test out the market with your first hire, or want to scale your current operations, our team provides the guidance and support you need to succeed.

Schedule a consultation to discuss your business expansion goals and how you can easily start hiring employees wherever in North America!

Disclaimer: The information provided here does not, and is not intended to, constitute legal advice. Instead, the information and content available are for general informational purposes only.

Explore Our Latest Resources

European Expansion Day 2026

Book your 30 minute slot in our US Expansion Clinic to find out the best practices for entering and scaling…

Global Staffing Industry Trends 2026

In this forecast, we analyse key staffing industry trends, market sizes, and predictions for the year ahead.

The 10 Best States for Business in 2026

If you’re thinking about entering the US market or employing remote employees in other states, Workwell Global’s data-backed approach will…